B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The use of a credit card is most similar to:

A) Paying with a check

B) An ACH (automatic clearinghouse) transaction

C) Purchasing a certificate of deposit

D) Obtaining a short-term loan

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When paper money is designated as legal tender, it means that:

A) It is printed by the government

B) Its supply is controlled by the government

C) It is a means of payment by law

D) It will be accepted by the government

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The blurring of the lines separating the subsets of the financial industry started in the:

A) 1940s

B) 1960s

C) 1970s

D) 1990s

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The Federal Reserve System is the institution that issues the U.S. paper currency or dollar bills.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economic studies conducted in industrially advanced countries suggest there is:

A) A positive relationship between the degree of independence of the central bank and the size of the average annual rate of inflation

B) An inverse relationship between the degree of independence of the central bank and the size of the average annual rate of inflation

C) No relationship between the degree of independence of the central bank and the size of the average annual rate of inflation

D) A positive relationship between the degree of independence of the central bank and the size of the central bank

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The so-called moral-hazard problem in financial management refers to the fact that managers will tend to take on more risk if they know that they are somehow insured against some or all of their losses.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The twelve Federal Reserve Banks can best be characterized as:

A) Central banks, banker's banks, and quasi-public banks

B) Regional banks, public banks, and member banks

C) Investment banks, banker's banks, and public banks

D) National banks, quasi-public banks, and investment banks

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Federal Reserve System performs the following functions, except:

A) Issuing the paper currency in the economy

B) Providing banking services to the general public

C) Providing financial services to the Federal government

D) Lending money to banks and thrifts

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The bail-out money given to the car companies GM and Chrysler came from the Fed acting in its role as "lender of last resort".

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As of February 2013, more than half of the money supply (M1) was in the form of:

A) Currency

B) Checkable deposits

C) Gold coins and bars

D) Savings deposits

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The Federal Open Market Committee (FOMC) regulates markets and enforces antitrust laws to keep markets open and competitive.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which definition(s) of the money supply include(s) only items which are directly and immediately usable as a medium of exchange?

A) M1

B) M2

C) Neither M1 nor M2

D) M1 and M2

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items are included in money supply M2 but not M1?

A) Federal Reserve notes

B) Coins

C) Savings deposits

D) Checkable deposits

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Federal Open Market Committee (FOMC) of the Federal Reserve System is primarily for:

A) Maintaining cash reserves that can be used to settle international transactions

B) Supervising banks to make sure that markets are open to all and remain competitive

C) Issuing currency and acting as the fiscal agent for the Federal government

D) Setting the Fed's monetary policy and directing the purchase and sale of government securities

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

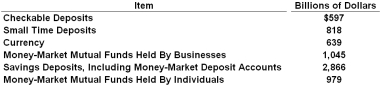

Refer to the table above. The value of the money included in M2 but not counted in M1 is:

Refer to the table above. The value of the money included in M2 but not counted in M1 is:

A) $1,457 billion

B) $4,442 billion

C) $2,886 billion

D) $4,663 billion

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The currency or money of the United States, like those of other countries, is:

A) Commodity money

B) Intrinsic money

C) Token money

D) Deposit money

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What "backs" the money supply of the U.S.?

A) The U.S. government's ability to keep the value of money relatively stable

B) The amount of gold the U.S. government has on deposit at its banks

C) The fact that currency is issued by the Federal Reserve System

D) The fact that the intrinsic value of coins in circulation is greater than their face value

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Federal Reserve Banks are owned by the:

A) Federal government

B) Board of Governors

C) United States Treasury

D) Member banks

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Members of the Federal Reserve Board of Governors are:

A) Appointed by Congress to staggered 14-year terms

B) Selected by the Federal Open Market Committee for 4-year terms

C) Appointed by the President to staggered 14-year terms

D) Selected by each of the Federal Reserve banks for 4-year terms

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 130

Related Exams