A) Actual reserves minus required reserves

B) Assets plus net worth and liabilities

C) Excess reserves times the monetary multiplier

D) Excess reserves divided by the monetary multiplier

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An individual deposits $12,000 in a commercial bank. The bank is required to hold 10 percent of all deposits on reserve at the regional Federal Reserve Bank. The deposit increases the loan capacity of the bank by:

A) $11,000

B) $10,800

C) $9,600

D) $6,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is one significant consequence of fractional reserve banking?

A) Banks are vulnerable to "panics" or "bank runs"

B) Banks can only lend an amount equal to its deposits

C) Banks hold a portion of their deposits in gold

D) Banks can serve the withdrawals of all their depositors

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Federal Reserve System sells $5 billion of government securities to commercial banks, the banks' reserves would:

A) Increase by $5 billion

B) Decrease by $5 billion

C) Be added to net worth

D) Remain the same

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Bank A has excess reserves of $1 million and all other banks in the system do not have any excess reserves, then the amount of additional loans that can be made by the banking system will be:

A) $1 million also

B) A fraction of $1 million

C) A multiple of $1 million

D) $1 million times the required-reserve ratio

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The use of high leveraging by banks leads to the banking system's:

A) Competitiveness

B) Instability

C) Vital role in the economy

D) Monopoly power

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

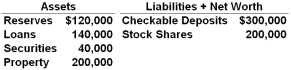

The following table is the consolidated balance sheet for the commercial banking system. All figures are in billions. Assume that the required reserve ratio is 10 percent:  Refer to the above information. The maximum amount by which this commercial banking system can expand the supply of money by lending is:

Refer to the above information. The maximum amount by which this commercial banking system can expand the supply of money by lending is:

A) $120,000 billion

B) $300,000 billion

C) $600,000 billion

D) $900,000 billion

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The amount of required reserves that a bank must hold is computed as a certain fraction of the bank's assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is one significant characteristic of fractional reserve banking?

A) Banks hold a fraction of their loans in reserve

B) Banks use deposit insurance for loans to customers

C) Bank loans will be equal to the amount of gold on deposit

D) Banks can create money through lending their reserves

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary reason commercial banks must keep required reserves on deposit at the Fed is to:

A) Add to the liquidity of the commercial bank

B) Allow the Fed to control the amount of bank lending

C) Protect the deposits in the commercial bank against losses

D) Ensure that depositors can withdraw their money if they wish to

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The federal funds rate is the interest rate that the Fed charges banks for its loans to them.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

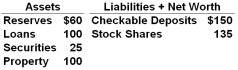

Answer the question based on the following consolidated balance sheet for the commercial banking system. Assume the required reserve ratio is 12 percent. All figures are in billions of dollars:  Refer to the above data. The commercial banking system has excess reserves of:

Refer to the above data. The commercial banking system has excess reserves of:

A) $32 billion

B) $36 billion

C) $42 billion

D) $60 billion

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One way to enhance the stability of the banking system is to:

A) Require higher bank capitalization or net worth

B) Increase the federal funds rate

C) Reduce the required-reserve ratio

D) Require more leveraging by banks

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

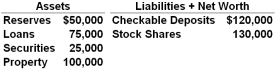

Answer the question based on the following balance sheet for the First National Bank. Assume the reserve ratio is 15 percent:  Refer to the above data. First National Bank can make new loans of up to:

Refer to the above data. First National Bank can make new loans of up to:

A) $50,000

B) $41,000

C) $32,000

D) $27,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Henry deposits $2,000 in currency in the First Street Bank. Later that same day Jane Harris negotiates a loan for $5,400 at the same bank. After these transactions, the supply of money has:

A) Increased by $2,100

B) Increased by $3,300

C) Increased by $5,400

D) Decreased by $3,300

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

One bank can borrow reserves from another bank, and the interest on the loan is called the federal funds rate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the Northwestern Bank has excess reserves of $12,000 and checkable deposits of $125,000. If the reserve requirement is 20 percent, what are the bank's actual reserves?

A) $25,000

B) $37,000

C) $44,000

D) $47,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In an unregulated environment, the commercial banking system would tend to vary the supply of money in a way that:

A) Increased the money supply to the maximum at all times

B) Decreased the money supply to the minimum at all times

C) Emphasized the use of currency over demand deposits

D) Reinforced cyclical variations in the economy

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In essence, which of the following groups "creates" money?

A) Banks' loan officers when they grant loans

B) Consumers when they go shopping

C) Depositors when they deposit or withdraw money from their banks

D) Firms when they pay workers their wages and salaries

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When loans are repaid at commercial banks:

A) Money is created

B) Money is destroyed

C) The assets of commercial banks increase

D) The net worth of commercial banks increases

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 127

Related Exams