B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

The entry to close the Accumulated Depreciation account may include a debit to

A) the Income Summary account and a credit to the Accumulated Depreciation account.

B) the Depreciation Expense account and a credit to the Accumulated Depreciation account.

C) the Accumulated Depreciation account and a credit to the Income Summary account.

D) none of the above.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

After all the closing entries are posted to the ledger, the Income Summary account will have a ____________________ balance.

Correct Answer

verified

Correct Answer

verified

Essay

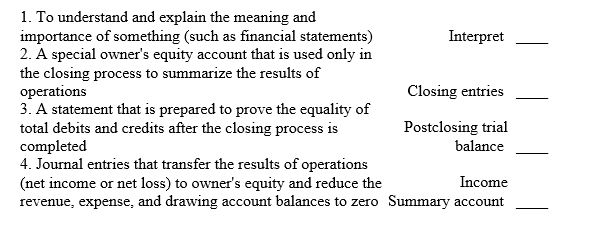

Match the accounting terms with the description by entering the proper number.

Correct Answer

verified

Correct Answer

verified

Essay

On December 31, the Income Summary account of Coulter Company has a credit balance of $20,000 after revenue of $89,000 and expenses of $69,000 were closed to the account. Joseph Coulter, Drawing has a debit balance of $3,000 and Joseph Coulter, Capital has a credit balance of $45,000. Record the journal entries necessary to complete closing the accounts. Use 14 as the general journal page number. Then, post the closing entries to the Joseph Coulter, Capital account.

Correct Answer

verified

Correct Answer

verified

Short Answer

The firm had net income if the entry to close the Income Summary account is recorded as a ____________________ to the owner's capital account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to close the Depreciation Expense account would include a debit to

A) the Income Summary account and a credit to the Depreciation Expense account.

B) the Income Summary and a credit to Cash.

C) Cash and a credit to the Income Summary account.

D) the Depreciation Expense account and a credit to the Income Summary account.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When done properly, how many journal entries are involved in the closing process?

A) 2

B) 3

C) 4

D) 5

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The temporary owner's equity accounts are closed because they apply to only one accounting period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts is a permanent account?

A) Supplies

B) Supplies Expense

C) Owner's drawing

D) Fees Income

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

One of the purposes of closing entries is to transfer net income or net loss for the period to the owner's capital account.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a business has a net loss for a fiscal period, the journal entry to close the Income Summary account is

A) a debit to Income Summary and a credit to Fees Income.

B) a debit to Income Summary and a credit to Capital.

C) a debit to Capital and a credit to Income Summary.

D) a debit to Capital and a credit to Drawing.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

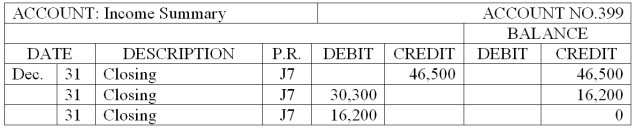

The Income Summary and Karen Randall, Capital accounts for Randall Printing Company at the end of its accounting period follow.

Complete the following statements.

A. Total revenue for the period is ____________________.

B. Total expenses for the period are ____________________.

C. Net income (loss) for the period is ____________________.

D. Owner's withdrawals for the period are ____________________.

Complete the following statements.

A. Total revenue for the period is ____________________.

B. Total expenses for the period are ____________________.

C. Net income (loss) for the period is ____________________.

D. Owner's withdrawals for the period are ____________________.

Correct Answer

verified

(A) $46,500, (B) $30,300, (C) $16,200 Net Income, (D) $6,000

Correct Answer

verified

Multiple Choice

Entries required to zero the balances of the temporary accounts at the end of the year are called

A) posting entries.

B) adjusting entries.

C) closing entries.

D) correcting entries.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

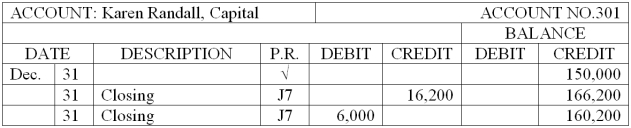

Managers often consult financial statements for specific types of information. Indicate whether each of the following items would appear on the income statement, statement of owner's equity, or the balance sheet. Note that an item may appear on more than one statement. The first item is completed as an example.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One purpose of closing entries is to

A) transfer the results of operations to owner's equity.

B) reduce the owner's capital account balance to zero so that the account is ready for the next period.

C) adjust the ledger account balances to provide complete and accurate figures for use on financial statements.

D) close all accounts so that the ledger is ready for the next accounting period.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

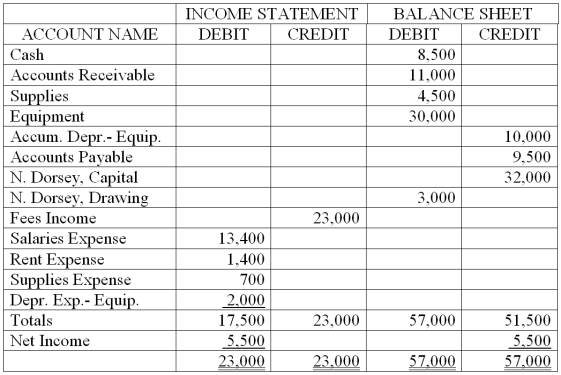

Dorsey Company's partial worksheet for the month ended March 31, 2013, is shown below. Open the owner's capital account (account number 301) in the general ledger and record the March 1, 2013, balance of $32,000 shown on the worksheet. Journalize the closing entries on page 3 of a general journal. Post the closing entries to the owner's capital account. Prepare a postclosing trial balance.

Correct Answer

verified

Correct Answer

verified

Short Answer

The ____________________ entries reduce the balances of the revenue, expense, and drawing accounts to zero so that they are ready to receive data for the next period.

Correct Answer

verified

closing

Correct Answer

verified

True/False

The entry to close the revenue account Fees Income requires a debit to that account.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following entries records the closing of Penny Pincher, Drawing at the end of the accounting period?

A) Debit Penny Pincer, Drawing; credit Penny Pincher, Capital

B) Debit Penny Pincher, Capital; credit Income Summary

C) Debit Income Summary; credit Penny Pincher, Drawing

D) Debit Penny Pincher, Capital; credit Penny Pincher, Drawing

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 83

Related Exams