A) ability-to-pay

B) tax fairness

C) benefits

D) affordability

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax system is poorly designed,it may be possible to increase:

A) efficiency without sacrificing equity.

B) equity while causing inefficiency.

C) efficiency by sacrificing equity.

D) equity without causing inefficiency or increase efficiency without sacrificing equity.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax system _____ when taxes are distributed fairly.

A) is efficient

B) is equitable

C) has no deadweight loss

D) is in equilibrium

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which tax BEST illustrates the ability-to-pay principle of tax fairness?

A) The municipal playground is funded by a tax on all citizens.

B) Roads and highways are built and maintained by revenue from a tax on gasoline.

C) A property tax that is proportional to the value of the home is charged to homeowners to fund primary and secondary education.

D) A sales tax on food pays for police and fire protection.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which situation demonstrates the benefits principle?

A) Employed workers pay taxes that are used to fund technical training programs.

B) Revenue from the federal tax on gasoline is used to maintain and improve highway infrastructure.

C) Most of the revenue from property taxes is used to fund public schools.The taxes are paid by all homeowners.

D) Taxes on cigarettes are used to pay provincial employees' salaries.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Since the terrorist attacks of 9/11 (on the World Trade Centre,in New York City) ,many federal airline regulatory bodies have added a small security fee to every airplane ticket purchased.This is an example of:

A) the benefits principle of tax fairness.

B) a lump-sum tax.

C) the ability-to-pay principle of tax fairness.

D) a profits tax.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The benefits principle of taxation means individuals pay according to:

A) whether and how much they use a good or service.

B) benefits gained by society as a whole.

C) benefits to government from having taxpayers.

D) ability to pay.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A _____ tax takes a fixed percentage of income,regardless of the level of income.

A) proportional

B) benefits

C) progressive

D) regressive

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The deadweight loss from an excise tax comes about because:

A) the number of transactions in the market is smaller than the no-tax equilibrium.

B) some mutually beneficial transactions do not take place.

C) a quota rent exists.

D) the number of transactions in the market is reduced and some mutually beneficial transactions do not take place.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Given any downward-sloping demand curve for a good,the more price-elastic the supply curve,the _____ equilibrium output will fall and the _____ will be the deadweight loss when the government imposes an excise tax.

A) more;smaller

B) more;larger

C) less;smaller

D) less;larger

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

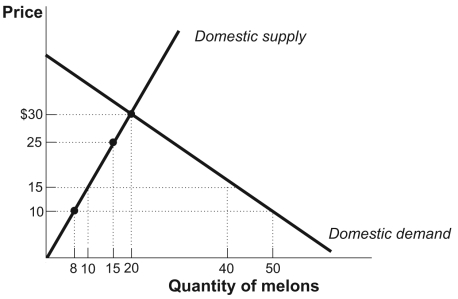

Use the following to answer questions :

Figure: The Market for Melons in Russia II  -Recently,the government considered adding an excise tax on CDs that can be used to record music and CD players that can record discs.If this tax were enacted,the MOST likely effect would be:

-Recently,the government considered adding an excise tax on CDs that can be used to record music and CD players that can record discs.If this tax were enacted,the MOST likely effect would be:

A) that consumers would pay a higher price and producers would sell fewer of these CDs and CD players than before the tax.

B) no change in consumption or the prices paid by consumers of these CDs and CD players.

C) that consumers would pay a lower price and producers would receive a higher price for these CDs and CD players than before the tax.

D) an increase in economic activity due to the tax.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

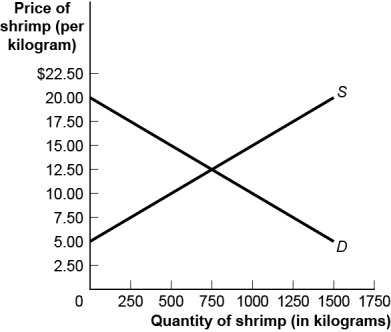

Use the following to answer questions :

Figure: The Shrimp Market  -(Figure: The Shrimp Market) Use Figure: The Shrimp Market.If the government wants to limit shrimp sales to 500 kilograms,it can impose a _____ excise tax on sellers,and the total tax revenue generated will be _____.

-(Figure: The Shrimp Market) Use Figure: The Shrimp Market.If the government wants to limit shrimp sales to 500 kilograms,it can impose a _____ excise tax on sellers,and the total tax revenue generated will be _____.

A) $5;$2 500

B) $7.50;$7 500

C) $10;$2 500

D) The answer cannot be determined from the information provided.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax system achieves equity when:

A) taxes are distributed fairly,however society may define fair.

B) it minimizes the costs to the economy of tax collection.

C) it is efficient.

D) taxes are lump sum.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Because of tax competition,provincial and municipal taxes tend to be _____;however,federal taxes tend to be _____.

A) regressive;regressive

B) progressive;regressive

C) progressive;progressive

D) regressive;progressive

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which tax is the LARGEST source of federal government revenue?

A) sales

B) property

C) individual income

D) death

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

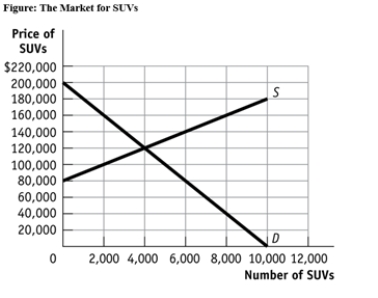

Use the following to answer questions :  -(Figure: The Market for SUVs) Use Figure: The Market for SUVs.A price _____ of _____ will bring the about the same price and output in the market for SUVs as would an excise tax of $60 000.

-(Figure: The Market for SUVs) Use Figure: The Market for SUVs.A price _____ of _____ will bring the about the same price and output in the market for SUVs as would an excise tax of $60 000.

A) ceiling;$80 000

B) ceiling;$100 000

C) floor;$100 000

D) floor;$160 000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following to answer questions : \text {The market for good \mathrm { X } can be depicted with the following demand and supply equations:} -(Scenario: The Market for Good X) Use Scenario: The Market for Good X.The per-unit tax incidence on producers is equal to (round all calculations to two decimal places) :

A) $1.00.

B) $0.40.

C) $58.80.

D) $60.00.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

To minimize deadweight loss,excise taxes should be levied on goods with inelastic demand and inelastic supply rather than goods with elastic demand and elastic supply.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax system achieves efficiency when:

A) the right people actually bear the burden of taxes.

B) it minimizes the costs to the economy of tax collection.

C) the tax is fair.

D) it is in equilibrium.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A principle suggesting that people with more income or wealth should pay more taxes is the _____ principle.

A) ability-to-pay

B) proportional tax

C) lump-sum tax

D) benefits received

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 280

Related Exams