B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Projects S and L are equally risky, mutually exclusive, and have normal cash flows.Project S has an IRR of 15%, while Project L's IRR is 12%.The two projects have the same NPV when the WACC is 7%.Which of the following statements is CORRECT?

A) If the WACC is 6%, Project S will have the higher NPV.

B) If the WACC is 13%, Project S will have the lower NPV.

C) If the WACC is 10%, both projects will have a negative NPV.

D) Project S's NPV is more sensitive to changes in WACC than Project L's.

E) If the WACC is 10%, both projects will have positive NPVs.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

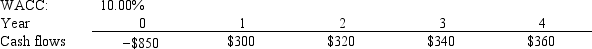

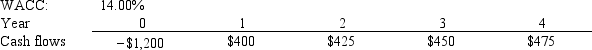

Watts Co.is considering a project that has the following cash flow and WACC data.What is the project's MIRR? Note that a project's MIRR can be less than the WACC (and even negative) , in which case it will be rejected.

A) 14.08%

B) 15.65%

C) 17.21%

D) 18.94%

E) 20.83%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) One defect of the IRR method versus the NPV is that the IRR does not take account of the time value of money.

B) One defect of the IRR method versus the NPV is that the IRR does not take account of the cost of capital.

C) One defect of the IRR method versus the NPV is that the IRR values a dollar received today the same as a dollar that will not be received until sometime in the future.

D) One defect of the IRR method versus the NPV is that the IRR does not take proper account of differences in the sizes of projects.

E) One defect of the IRR method versus the NPV is that the IRR does not take account of cash flows over a project's full life.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The phenomenon called "multiple internal rates of return" arises when two or more mutually exclusive projects that have different lives are compared to one another.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Conflicts between two mutually exclusive projects occasionally occur, where the NPV method ranks one project higher but the IRR method ranks the other one first.In theory, such conflicts should be resolved in favor of the project with the higher positive IRR.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a project has "normal" cash flows, then its MIRR must be positive.

B) If a project has "normal" cash flows, then it will have exactly two real IRRs.

C) The definition of "normal" cash flows is that the cash flow stream has one or more negative cash flows followed by a stream of positive cash flows and then one negative cash flow at the end of the project's life.

D) If a project has "normal" cash flows, then it can have only one real IRR, whereas a project with "nonnormal" cash flows might have more than one real IRR.

E) If a project has "normal" cash flows, then its IRR must be positive.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Poder Inc.is considering a project that has the following cash flow data.What is the project's payback?

A) 1.91 years

B) 2.12 years

C) 2.36 years

D) 2.59 years

E) 2.85 years

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A firm should never accept a project if its acceptance would lead to an increase in the firm's cost of capital (its WACC).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

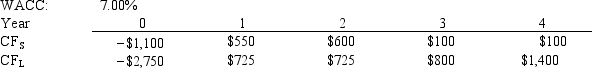

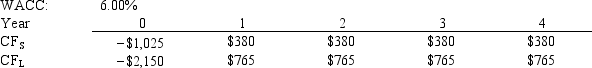

Langton Inc.is considering Projects S and L, whose cash flows are shown below.These projects are mutually exclusive, equally risky, and not repeatable.The CEO believes the IRR is the best selection criterion, while the CFO advocates the MIRR.If the decision is made by choosing the project with the higher IRR rather than the one with the higher MIRR, how much, if any, value will be forgone.In other words, what's the NPV of the chosen project versus the maximum possible NPV? Note that (1) "true value" is measured by NPV, and (2) under some conditions the choice of IRR vs.MIRR will have no effect on the value lost.

A) $185.90

B) $197.01

C) $208.11

D) $219.22

E) $230.32

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is NOT a disadvantage of the regular payback method?

A) Ignores cash flows beyond the payback period.

B) Does not directly account for the time value of money.

C) Does not provide any indication regarding a project's liquidity or risk.

D) Does not take account of differences in size among projects.

E) Lacks an objective, market-determined benchmark for making decisions.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The internal rate of return is that discount rate that equates the present value of the cash outflows (or costs)with the present value of the cash inflows.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If you were evaluating two mutually exclusive projects for a firm with a zero cost of capital, the payback method and NPV method would always lead to the same decision on which project to undertake.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

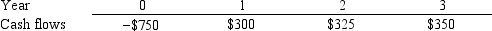

McGlothin Inc.is considering a project that has the following cash flow data.What is the project's payback?

A) 1.86 years

B) 2.07 years

C) 2.30 years

D) 2.53 years

E) 2.78 years

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are on the staff of O'Hara Inc.The CFO believes project acceptance should be based on the NPV, but Andrew O'Hara, the president, insists that no project should be accepted unless its IRR exceeds the project's risk-adjusted WACC.Now you must make a recommendation on a project that has a cost of $15, 000 and two cash flows: $110, 000 at the end of Year 1 and -$100, 000 at the end of Year 2.The president and the CFO both agree that the appropriate WACC for this project is 10%.At 10%, the NPV is $2, 355.37, but you find two IRRs, one at 6.33% and one at 527%, and a MIRR of 11.32%.Which of the following statements best describes your optimal recommendation, i.e., the analysis and recommendation that is best for the company and least likely to get you in trouble with either the CFO or the president?

A) You should recommend that the project be rejected because, although its NPV is positive, it has an IRR that is less than the WACC.

B) You should recommend that the project be accepted because (1) its NPV is positive and (2) although it has two IRRs, in this case it would be better to focus on the MIRR, which exceeds the WACC.You should explain this to the president and tell him that the firm's value will increase if the project is accepted.

C) You should recommend that the project be rejected.Although its NPV is positive it has two IRRs, one of which is less than the WACC, which indicates that the firm's value will decline if the project is accepted.

D) You should recommend that the project be rejected because, although its NPV is positive, its MIRR is less than the WACC, and that indicates that the firm's value will decline if it is accepted.

E) You should recommend that the project be rejected because its NPV is negative and its IRR is less than the WACC.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows.

A) A project's MIRR is always less than its regular IRR.

B) If a project's IRR is greater than its WACC, then the MIRR will be less than the IRR.

C) If a project's IRR is greater than its WACC, then the MIRR will be greater than the IRR.

D) To find a project's MIRR, we compound cash inflows at the IRR and then discount the terminal value back to t = 0 at the WACC.

E) A project's MIRR is always greater than its regular IRR.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

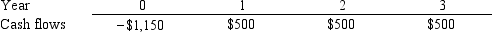

Murray Inc.is considering Projects S and L, whose cash flows are shown below.These projects are mutually exclusive, equally risky, and not repeatable.The CEO wants to use the IRR criterion, while the CFO favors the NPV method.You were hired to advise Murray on the best procedure.If the wrong decision criterion is used, how much potential value would Murray lose?

A) $188.68

B) $198.61

C) $209.07

D) $219.52

E) $230.49

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Projects C and D both have normal cash flows and are mutually exclusive.Project C has a higher NPV if the WACC is less than 12%, whereas Project D has a higher NPV if the WACC exceeds 12%.Which of the following statements is CORRECT?

A) Project D is probably larger in scale than Project C.

B) Project C probably has a faster payback.

C) Project C probably has a higher IRR.

D) The crossover rate between the two projects is below 12%.

E) Project D probably has a higher IRR.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering two mutually exclusive, equally risky, projects.Both have IRRs that exceed the WACC.Which of the following statements is CORRECT? Assume that the projects have normal cash flows, with one outflow followed by a series of inflows.

A) If the cost of capital is greater than the crossover rate, then the IRR and the NPV criteria will not result in a conflict between the projects.The same project will rank higher by both criteria.

B) If the cost of capital is less than the crossover rate, then the IRR and the NPV criteria will not result in a conflict between the projects.The same project will rank higher by both criteria.

C) For a conflict to exist between NPV and IRR, the initial investment cost of one project must exceed the cost of the other.

D) For a conflict to exist between NPV and IRR, one project must have an increasing stream of cash flows over time while the other has a decreasing stream.If both sets of cash flows are increasing or decreasing, then it would be impossible for a conflict to exist, even if one project is larger than the other.

E) If the two projects' NPV profiles do not cross, then there will be a sharp conflict as to which one should be selected.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Yoga Center Inc.is considering a project that has the following cash flow and WACC data.What is the project's NPV? Note that a project's expected NPV can be negative, in which case it will be rejected.

A) $41.25

B) $45.84

C) $50.93

D) $56.59

E) $62.88

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 108

Related Exams