A) vertical analysis

B) solvency analysis

C) profitability analysis

D) horizontal analysis

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

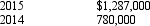

Assume the following sales data for a company:  What is the percentage increase in sales from 2014 to 2015?

What is the percentage increase in sales from 2014 to 2015?

A) 100%

B) 65%

C) 165%

D) 60.1%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Leveraging implies that a company

A) contains debt financing.

B) contains equity financing.

C) has a high current ratio.

D) has a high earnings per share.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Corporate annual reports typically do not contain which of the following?

A) management discussion and analysis

B) SEC statement expressing an opinion

C) accompanying foot notes

D) auditor's report

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Using vertical analysis of the income statement, a company's net income as a percentage of net sales is 15%; therefore, the cost of goods sold as a percentage of sales must be 85%.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

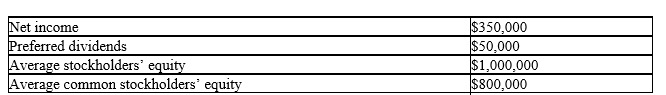

A company reports the following:

Determine the (a) rate earned on stockholders' equity, and (b) rate earned on common stockholders' equity. Round your answer to one decimal place.

Determine the (a) rate earned on stockholders' equity, and (b) rate earned on common stockholders' equity. Round your answer to one decimal place.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

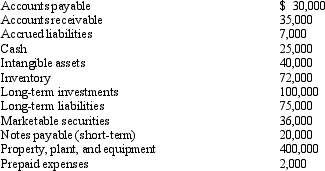

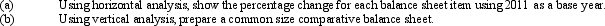

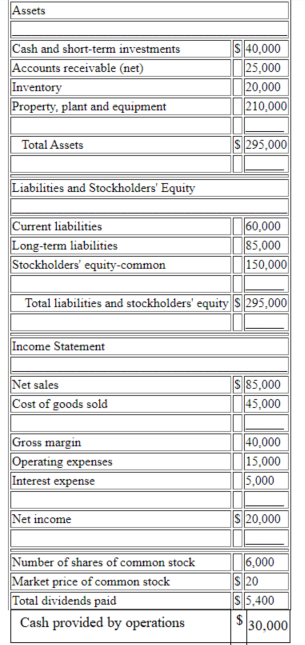

Based on the above data, what is the quick ratio, rounded to one decimal point?

Based on the above data, what is the quick ratio, rounded to one decimal point?

A) 1.7

B) 2.9

C) 1.1

D) 1.0

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Factors which reflect the ability of a business to pay its debts and earn a reasonable amount of income are referred to as solvency and profitability.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Horizontal analysis of comparative financial statements includes the

A) development of common size statements.

B) calculation of liquidity ratios.

C) calculation of dollar amount changes and percentage changes from the previous to the current year.

D) the evaluation of each component in a financial statement to a total within the statement.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

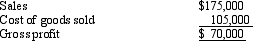

Income statement information for Lucy Company is provided below:

Prepare a vertical analysis of the income statement for Lucy Company.

Prepare a vertical analysis of the income statement for Lucy Company.

Correct Answer

verified

Correct Answer

verified

True/False

Dollar amounts of working capital are difficult to assess when comparing companies of different sizes or in comparing such amounts with industry figures.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A balance sheet shows cash, $75,000; marketable securities, $115,000; receivables, $150,000 and $222,500 of inventories. Current liabilities are $225,000. The current ratio is 2.5 to 1.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

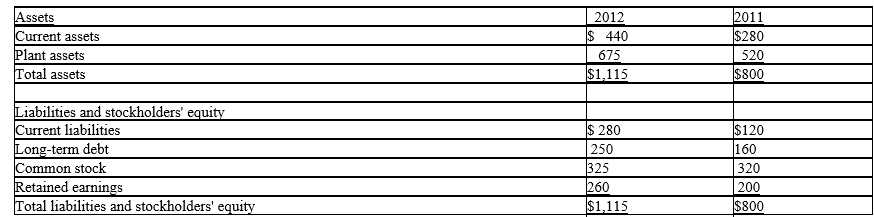

The comparative balance sheet of Ramos Company appears below:

(a) RAMOS COMPANY

Comparative Balance Sheet

December 31, 2012 and 2011

Instructions

Instructions

Round percentage to one decimal place.

Round percentage to one decimal place.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In horizontal analysis, each item is expressed as a percentage of the

A) base year figure.

B) retained earnings figure.

C) total assets figure.

D) net income figure.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information pertains to Carlton Company. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit.  What is the price earnings ratio for this company? Round your answer to one decimal point.

What is the price earnings ratio for this company? Round your answer to one decimal point.

A) 8.0 times

B) 2.5 times

C) 4.0 times

D) 6.0 times

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Using measures to assess a business's ability to pay its current liabilities is called current position analysis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should be reported net of the related income tax effect on the income statement?

A) sale of an inventory item at a loss

B) loss due to sale of fixed assets

C) loss due to a discontinued operations of the business

D) sale of a temporary investment at a loss

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the above data, what is the amount of quick assets?

Based on the above data, what is the amount of quick assets?

A) $205,000

B) $203,000

C) $131,000

D) $66,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An extraordinary loss of $300,000 that results in income tax savings of $90,000 should be reported as an extraordinary loss (net of tax) of $210,000 on the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The ratio of the sum of cash, receivables, and marketable securities to current liabilities is referred to as the current ratio.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 184

Related Exams