A) $7,751,200

B) $7,028,800

C) $7,080,900

D) $7,030,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation declares a dividend of $0.50 per share on 10,000 shares of common stock.Which of the following would be included in the entry to record the declaration?

A) Retained Earnings would be debited for $5,000

B) Paid-In Capital in Excess of Par-Common would be credited for $5,000

C) Retained Earnings would be credited for $5,000

D) Dividends Payable-Common would be debited for $5,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

On December 1,2015,Arther Inc.had 200,000 shares of $1 par value common stock issued and outstanding.The next day they declared and distributed a 50% stock dividend.The market value of the stock on that date was $9 per share.Provide the journal entry for the transaction.

Correct Answer

verified

11ea84d1_1149_9e56_83dc_0d70711c51f9_TB3006_00

Correct Answer

verified

Multiple Choice

Which of the following statements is true?

A) Appropriations of retained earnings require journal entries,but restrictions on retained earnings do not.

B) No journal entries are needed to either appropriate or restrict retained earnings.

C) Both appropriations and restrictions of retained earnings require journal entries.

D) Restrictions on retained earnings must be journalized,but appropriations do not need to be journalized.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a true of the difference between a stock split and a stock dividend?

A) A stock split will increase total stockholders' equity,but a stock dividend will not.

B) Neither a stock split nor a stock dividend will increase total stockholders' equity.

C) A stock dividend will increase total stockholders' equity,but a stock split will not.

D) A stock split will decrease retained earnings,but a stock dividend will not.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Preferred stock is a stock ________.

A) that sells for a very high price

B) that is distributed to employees of the company as a performance incentive

C) that is distributed by corporations to avoid liquidation

D) that gives its owners certain benefits over common stock

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A deficit occurs when a company has reoccurring losses and/or declares dividends in excess of retained earnings.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a reason for a company to announce a stock split?

A) to defend against a hostile takeover

B) to double the par value of the share

C) to reduce the market price at which the stock is trading

D) to provide the shareholders with something of value,when the company cannot afford a cash dividend

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

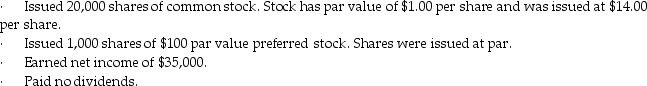

Lerner Inc.had the following transactions in 2015,its first year of operations.  -At the end of 2015,what is the total amount of stockholders' equity?

-At the end of 2015,what is the total amount of stockholders' equity?

A) $415,000

B) $120,000

C) $260,000

D) $380,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Occidental Produce Inc.has 40,000 shares of common stock outstanding and 2,000 shares of preferred stock outstanding.The common stock is $0.01 par value; the preferred stock is 4% noncumulative,with $100 par value.On October 15,2015,the company declares a total dividend payment of $40,000.What is the total amount of dividends that will be paid to the common stockholders?

A) $40,000

B) $32,000

C) $400

D) $4,500

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

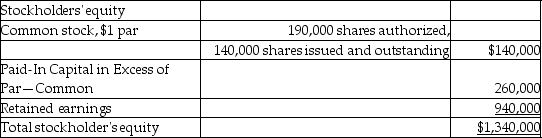

On June 30,2015,Roger Inc.showed the following data on the equity section of their balance sheet:  On July 1,2015,the company declared and distributed a 5% stock dividend.The market value of the stock at that time was $13 per share.Following this transaction,what would be the new balance in the Common stock account?

On July 1,2015,the company declared and distributed a 5% stock dividend.The market value of the stock at that time was $13 per share.Following this transaction,what would be the new balance in the Common stock account?

A) $147,000

B) $26,000

C) $66,000

D) $246,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following occurs when a corporation distributes a stock dividend?

A) Total liabilities would increase.

B) Total stockholders' equity would increase.

C) Total assets would decrease.

D) Total stockholders' equity would be unchanged.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

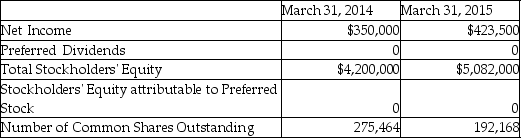

Revival Corporation's annual report is follows.  - Based on the information provided,find the rate of return on common stockholders' equity on March 31,2015.

- Based on the information provided,find the rate of return on common stockholders' equity on March 31,2015.

A) 8.28%

B) 9.13%

C) 4.56%

D) 6.81%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The declaration and payment of cash dividends cause a decrease in both assets (Cash)and stockholders' equity (Retained Earnings)for the corporation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A stock split,like any other stock issuance,cannot involve issuing more shares of stock than authorized in the corporate charter.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On November 1,2015,Oster Inc.declared a dividend of $3.00 per share.Oster Inc.has 20,000 shares of common stock outstanding and no preferred stock.Which of the following is the journal entry needed to record the declaration of dividends?

A) debit Dividends Payable-Common $60,000 and credit Retained Earnings $60,000

B) debit Retained Earnings $60,000 and credit Cash $60,000

C) debit Retained Earnings $60,000 and credit Dividends Payable-Common $60,000

D) debit Cash $60,000 and credit Dividends Payable-Common $60,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A dividend's declaration date is the date the corporation records which stockholders get dividend checks.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Which of the following explains the term "lack of mutual agency" of a corporation?

A) The liabilities of the corporation cannot be extended to the personal assets of the stockholder.

B) Shares of stock can be readily bought and sold by investors on the open market.

C) Stockholders are not authorized to sign contracts or make business commitments on behalf of the corporation.

D) Corporations pay income tax on corporate earnings,and shareholders pay personal income tax on corporate dividends and gains from sale of stock.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

ABC has 45,000 shares of $10 par common stock outstanding.They offer a stock split of 4-for-1.The effect of the split will be ________.

A) par stays at $10; total shares go to 11,250

B) par drops to $5; total shares stay at 45,000

C) par drops to $2.50; total shares go to 180,000

D) par goes to $40; total shares go to 180,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Stock dividends have no impact on the total amount of stockholders' equity.

B) False

Correct Answer

verified

True

Correct Answer

verified

Showing 1 - 20 of 158

Related Exams