A) the units-of-production method

B) the straight-line method

C) the double-declining-balance method

D) the first-in,first-out method

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An asset is said to be obsolete when a newer asset can perform the job more efficiently.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following depreciation methods allocates a varying amount of depreciation each year based on an asset's usage?

A) the straight-line method

B) the annuity method

C) the units-of-production method

D) the double-declining-balance method

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When a business sells a plant asset for book value,a gain or loss should be recorded.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

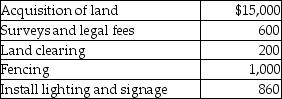

Acer Inc.plans to develop a shopping center.In the first quarter,they spent the following amounts:  -What amount should be recorded as the land improvements cost?

-What amount should be recorded as the land improvements cost?

A) $1,200

B) $1,800

C) $1,860

D) $800

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The units-of-production method allocates varying amounts of depreciation each year based on an asset's usage.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the year 2015,Sanchez Corp.sold goods and earned revenue of $16,000,000.The corporation's beginning total assets was $8,000,000.Its assets turnover ratio was 1.6 times.Calculate the ending total assets of Sanchez.

A) $12,000,000

B) $8,000,000

C) $14,000,000

D) $6,000,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

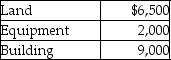

Hastings Corporation has purchased a group of assets for $15,000.The assets and their relative market values are listed below.  Which of the following amounts would be debited to the Land account?

Which of the following amounts would be debited to the Land account?

A) $1,962

B) $5,571

C) $1,714

D) $7,714

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,2015,Anodel Inc.acquired a machine for $1,000,000.The estimated useful life of the asset is 5 years.Residual value at the end of 5 years is estimated to be $50,000.Calculate the depreciation expense per year using the straight-line method.

A) $200,000

B) $190,000

C) $240,000

D) $250,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the correct accounting treatment for a patent?

A) A patent must be shown as a current asset on the balance sheet.

B) A patent must be depreciated or impaired,but not amortized.

C) A patent must be capitalized and amortized over 20 years or less.

D) A patent must be expensed,not capitalized,in the period in which it is purchased.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a characteristic of a plant asset,such as a building?

A) It is used in the operation of a business.

B) It is available for sale to customers in the ordinary course of business.

C) It has a short useful life.

D) It will have a negligible value at the end of its useful life.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In common with other intangible assets,goodwill must be amortized each year.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Equipment was purchased for $24,000.The equipment's estimated useful life was 5 years,and its residual value was $4,000.The straight-line method of depreciation was used.Calculate gain or loss on sale if the equipment is sold for $18,000 at the end of the first year.Give journal entry to record the sale of equipment at book value.

Correct Answer

verified

Correct Answer

verified

True/False

The double-declining-balance method ignores the residual value while calculating the amount of depreciation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A machine that was purchased for $100,000 has an accumulated depreciation of $70,000 as of the current date.The corporation exchanges the machine for a new machine.The new machine has a market value of $120,000 and the corporation pays cash of $100,000.Assume the exchange has commercial substance.What is the result of this exchange?

A) gain of $10,000

B) gain of $5,000

C) loss of $10,000

D) loss of $30,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The gain or loss on the sale of a plant asset is determined by comparing ________.

A) sale value and book value

B) sale value and residual value

C) sale value and original cost

D) book value and residual value

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

Trimer Corp sold a truck for $15,000 cash.It was originally purchased for $50,000 and had accumulated depreciation of $30,000 at the time of sale.Give the journal entry for the sale of truck.

Correct Answer

verified

Correct Answer

verified

Essay

On June 30,2015,Regal Furniture discarded fully depreciated equipment costing $35,000.Journalize the disposal of the equipment.

Correct Answer

verified

Correct Answer

verified

True/False

The asset turnover ratio measures the amount of net sales generated for each average dollar of total assets invested.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A photocopier costs $95,000 when new and has accumulated depreciation of $88,000.Suppose the corporation junks this machine and receives nothing.What is the result of the disposal transaction?

A) loss of $ 7,000

B) no gain or no loss

C) loss of $ 11,000

D) gain of $ 7,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 151

Related Exams