B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At Johnson Manufacturing the predetermined manufacturing overhead rate per direct labour hour is closest to

A) $13.33

B) $10.67

C) $11.67

D) $14.58

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Job 2301 requires $12,000 of direct materials,$5,000 of direct labour,500 direct labour hours,and 300 machine hours.Manufacturing overhead is computed at $15 per direct labour hour used and $12 per machine hour used. The total cost of Job 1547 is

A) $28,100

B) $11,100

C) $17,000

D) $24,500

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

When raw materials are transferred out of the storeroom to the factory,their cost is transferred out of raw materials inventory and into finished goods inventory.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fulton Corporation uses estimated direct labour hours of 210,000 and estimated manufacturing overhead costs of $840,000 in establishing manufacturing overhead rates.Actual manufacturing overhead was $960,000,and allocated manufacturing overhead was $980,000.What were the number of actual direct hours worked?

A) 214,375

B) 245,000

C) 183,750

D) 210,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead is underallocated if the amount

A) estimated for the period is greater than the actual amount incurred.

B) estimated for the period is less than the actual amount incurred.

C) allocated during the period is greater than the actual amount incurred.

D) allocated during the period is less than the actual amount incurred.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of direct materials used in production is recorded as a

A) debit to manufacturing overhead.

B) debit to work in process inventory.

C) debit to raw materials inventory.

D) debit to direct materials expense.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

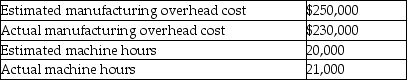

Smith Paints allocates overhead based on machine hours.Selected data for the most recent year follow.

The estimates were made as of the beginning of the year,while the actual results were for the entire year.

The manufacturing overhead for the year would have been

The estimates were made as of the beginning of the year,while the actual results were for the entire year.

The manufacturing overhead for the year would have been

A) $32,500 overallocated.

B) $32,500 underallocated.

C) $20,000 overallocated.

D) $20,000 underallocated.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wesley Corporation charged Job 110 with $12,000 of direct materials and $13,500 of direct labour.Allocation for manufacturing overhead is 80% of direct labour costs.What is the total cost of Job 110?

A) $10,800

B) $42,375

C) $36,300

D) $25,500

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the beginning work in process inventory at Harmon Manufacturing?

A) $17,000

B) $50,300

C) $53,400

D) $2,300

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The predetermined manufacturing overhead rate is calculated by multiplying the total estimated manufacturing overhead costs by the total estimated amount of the allocation base.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Willy's Wagons manufactures custom carts for a variety of uses.The following data has been recorded for Job 531,which was recently completed.Direct materials used cost $12,900.There were 210 direct labour hours worked on this job at a direct labour wage rate of $20 per hour.There were 165 machine hours used on this job.The predetermined overhead rate is $32 per machine hour used. What is the total manufacturing cost of Job 531?

A) $3,600

B) $22,380

C) $23,820

D) $6,555

F) All of the above

Correct Answer

verified

Correct Answer

verified

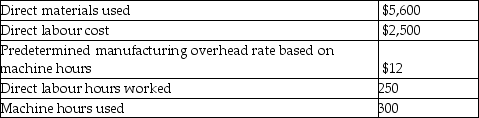

Multiple Choice

Star Corporation manufactures custom molds for use in the extrusion industry.The company allocates manufacturing overhead based on machine hours.Selected data for costs incurred for Job 732 are as follows:

What is the manufacturing cost of Job 732?

What is the manufacturing cost of Job 732?

A) $8,100

B) $11,700

C) $11,100

D) $3,600

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The total amount of overhead allocated to Job 2908 is

A) $23,750

B) $30,000

C) $41,250

D) $12,500

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If manufacturing overhead has been underallocated during the year,it means the jobs have been overcosted.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Job costing is most likely used in which of the following industries?

A) Chemicals

B) Food and beverage

C) Pharmaceuticals

D) Commercial building construction

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry to record $200 of depreciation expense on factory equipment involves a

A) debit to manufacturing overhead for $200.

B) debit to accumulated depreciation for $200.

C) debit to depreciation expense for $200.

D) credit to manufacturing overhead for $200.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What amount of manufacturing overhead would be allocated for the year at Buckley Corporation?

A) $729,000

B) $685,000

C) $769,500

D) $723,056

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In job costing,when indirect materials are requisitioned for a job,the raw materials inventory account is credited.

B) False

Correct Answer

verified

Correct Answer

verified

Matching

Match the following:

Correct Answer

Showing 201 - 220 of 302

Related Exams