A) 200;600

B) 400;800

C) 600;1,000

D) 1,000;1,400

E) 2,400;2,800

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Banks hold reserves

A) to earn interest.

B) to increase profits.

C) to escape the double coincidence of wants.

D) to meet depositor withdrawals and payments.

E) only because the government requires them to hold reserves.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When an individual deposits currency into a chequing account,

A) bank reserves increase,which increases the amount banks can lend,thereby increasing the money supply.

B) bank reserves decrease,which reduces the amount banks can lend,thereby reducing the money supply.

C) bank reserves are unchanged.

D) bank reserves decrease,which increases the amount banks can lend,thereby increasing the money supply.

E) bank reserves increase,which reduces the amount banks can lend,thereby reducing the money supply.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

M1 differs from M2 in that

A) M1 includes currency and balances held in chequing accounts,which are not included in M2.

B) M2 includes personal deposits and non-personal demand and notice deposits,which are not included in M1.

C) M2 includes small savings accounts,and money market mutual funds,which are not included in M1.

D) M1 is a broader measure of the money supply than M2.

E) the assets in M2 are more liquid than the assets in M1.

G) C) and D)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

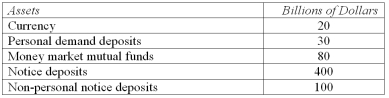

Based on the following information,compute the value of the M2 measure of the money supply.

A) $20 billion.

B) $50 billion.

C) $130 billion.

D) $550 billion.

E) $630 billion.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The money supply in Macroland is currently 3,000,bank reserves are 250,currency held by the public is 500,and the banks' desired reserve-deposit ratio is 10%.Assuming that the values of the currency held by the public and the desired reserve-deposit ratio do not change,if the Central Bank of Macroland wishes to decrease the money supply to 2,500,then it should conduct an open-market _________ government bonds to/from the public.

A) purchase of 50

B) purchase of 250

C) purchase of 500

D) sale of 50

E) sale of 500

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An episode when depositors,spurred by news or rumours of the imminent bankruptcy of one or more banks,rush to withdraw their deposits from the banking system is called a(n)

A) open-market withdrawal.

B) open-market sale.

C) banking panic.

D) bank run.

E) reserve requirement crisis.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The M1 measure of money consists of the sum of

A) currency and demand deposits.

B) currency and travellers' cheques.

C) currency,demand deposits,and savings deposits.

D) demand deposits and travellers' cheques.

E) demand and savings deposits.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Given a required reserve-deposit ratio of 5% for all banks and assuming individuals hold no cash,total bank reserves of $400 billion can support deposits of

A) $400 billion.

B) $800 billion.

C) $4,000 billion.

D) $8,000 billion.

E) $9,000 billion.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In Macroland,currency held by the public is 2000 econs,bank reserves are 600 econs,and the desired reserve-deposit ratio is 15%.If the central bank sells government bonds to the public in exchange for 300 econs that are then destroyed,the money supply in Macroland will decrease from ________ econs to ________ econs,assuming that the public does not wish to change the amount of currency it holds.

A) 2,000;1,700

B) 2,600;2,300

C) 2,990;2,645

D) 6,000;4,000

E) 7,000;6,000

G) A) and D)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

In Macroland,currency held by the public is 2000 econs,bank reserves are 300 econs,and the desired reserve-deposit ratio is 10%.If the central bank sells government bonds to the public in exchange for 200 econs that are then destroyed,the money supply in Macroland will decrease from _________ econs to _________ econs,assuming that the public does not wish to change the amount of currency it holds.

A) 2,000;1,800

B) 2,300;2,100

C) 3,000;1,000

D) 5,000;3,000

E) 6,000;2,000

G) B) and D)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

-The table above represents a bank's T-account.Suppose it is the only bank in town and individuals in town hold no cash.Assuming the reserve ratio is 10%,what will be the bank's loans at the end of the money creation process?

-The table above represents a bank's T-account.Suppose it is the only bank in town and individuals in town hold no cash.Assuming the reserve ratio is 10%,what will be the bank's loans at the end of the money creation process?

A) $180,000.

B) $200,000.

C) $1,800,000.

D) $2,000,000.

E) $2,200,000.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The equation stating that the rate of growth of the money supply equals the rate of inflation applies better to countries with ________ than to countries with ________.

A) zero inflation;hyperinflation

B) zero inflation;low or moderate inflation

C) low or moderate inflation;zero inflation

D) low or moderate inflation;high inflation

E) hyperinflation;low or moderate inflation

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An episode when depositors,spurred by news or rumours of the imminent bankruptcy of a particular bank,rush to withdraw their deposits from that bank is called a(n)

A) open-market withdrawal.

B) open-market sale.

C) banking panic.

D) bank run.

E) reserve requirement crisis.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After the central bank decreases reserves in the banking system through open-market sales,banks reduce deposits through multiple rounds of calling in loans and losing deposits until the

A) central bank requires them to stop.

B) reserve-deposit ratio reaches one-half.

C) actual reserve-deposit ratio is greater than the desired reserve-deposit ratio.

D) actual reserve-deposit ratio is equal to the desired reserve-deposit ratio.

E) actual reserve-deposit ratio is less than the desired reserve-deposit ratio.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the central bank sells $1,000,000 worth of government bonds to the public,the money supply

A) decreases by more than $1,000,000.

B) decreases by $1,000,000.

C) decreases by less than $1,000,000.

D) does not change.

E) increases by $1,000,000.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a bank's desired reserve-deposit ratio is 33% and it has deposit liabilities of $100 million and reserves of $50 million,it

A) has too few reserves and will reduce its lending.

B) has excess reserves and will increase its lending.

C) has the correct amount of reserves and outstanding loans.

D) should increase the amount of its reserves.

E) should decrease the amount of its reserves.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A promise by the central bank to maintain its key policy rate at the effective lower bound for an extended period of time is called a(n) ___________ commitment.

A) overnight lending

B) prime rate

C) credit easing.

D) zero interest rate.

E) long-term real interest rate

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the actual reserve-deposit ratio exceeds the desired reserve-deposit ratio,banks will

A) do nothing because this is a profitable situation.

B) stop making loans.

C) send the extra reserves to the central bank.

D) request that customers withdraw deposits from the bank.

E) make more loans in order to earn interest.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Holding money as a store of wealth has the advantage of being useful as a medium of exchange.The disadvantages of holding your wealth in the form of money are that it

A) may be stolen or lost,and people may think you're a smuggler or drug dealer.

B) is difficult to trace,and may be lost or stolen.

C) may be lost or stolen,and usually pays no interest.

D) pays no interest,and it is difficult to trace.

E) pays no interest,and people may think you're a smuggler or drug dealer.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 124

Related Exams