Correct Answer

verified

Correct Answer

verified

Multiple Choice

For European currency options written on euro with a strike price in dollars,what of the effect of an increase in the exchange rate S($/€) ?

A) Decrease the value of calls and puts ceteris paribus

B) Increase the value of calls and puts ceteris paribus

C) Decrease the value of calls, increase the value of puts ceteris paribus

D) Increase the value of calls, decrease the value of puts ceteris paribus

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Find the value today of your replicating today portfolio in euro.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The current spot exchange rate is $1.55 = €1.00; the three-month U.S.dollar interest rate is 2%.Consider a three-month American call option on €62,500 with a strike price of $1.50 = €1.00.What is the least that this option should sell for?

A) $0.05*62,500 = $3,125

B) $3,125/1.02 = $3,063.73

C) $0.00

D) none of the above

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For European options,what of the effect of an increase in St?

A) Decrease the value of calls and puts ceteris paribus

B) Increase the value of calls and puts ceteris paribus

C) Decrease the value of calls, increase the value of puts ceteris paribus

D) Increase the value of calls, decrease the value of puts ceteris paribus

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A European option is different from an American option in that

A) one is traded in Europe and one in traded in the United States.

B) European options can only be exercised at maturity; American options can be exercised prior to maturity.

C) European options tend to be worth more than American options, ceteris paribus.

D) American options have a fixed exercise price; European options' exercise price is set at the average price of the underlying asset during the life of the option.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Yesterday,you entered into a futures contract to buy €62,500 at $1.50 per €.Suppose the futures price closes today at $1.46.How much have you made/lost?

A) Depends on your margin balance.

B) You have made $2,500.00.

C) You have lost $2,500.00.

D) You have neither made nor lost money, yet.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The current spot exchange rate is $1.55 = €1.00 and the three-month forward rate is $1.60 = €1.00.Consider a three-month American call option on €62,500 with a strike price of $1.50 = €1.00.If you pay an option premium of $5,000 to buy this call,at what exchange rate will you break-even?

A) $1.58 = €1.00

B) $1.62 = €1.00

C) $1.50 = €1.00

D) $1.68 = €1.00

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Find the risk neutral probability of an "up" move.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With currency futures options the underlying asset is

A) foreign currency.

B) a call or put option written on foreign currency.

C) a futures contract on the foreign currency.

D) none of the above

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) Time value = intrinsic value + option premium

B) Intrinsic value = option premium + time value

C) Option premium = intrinsic value - time value

D) Option premium = intrinsic value + time value

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Three days ago,you entered into a futures contract to sell €62,500 at $1.50 per €.Over the past three days the contract has settled at $1.50,$1.52,and $1.54.How much have you made or lost?

A) Lost $0.04 per € or $2,500

B) Made $0.04 per € or $2,500

C) Lost $0.06 per € or $3,750

D) None of the above

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Today's settlement price on a Chicago Mercantile Exchange (CME) Yen futures contract is $0.8011/¥100.Your margin account currently has a balance of $2,000.The next three days' settlement prices are $0.8057/¥100,$0.7996/¥100,and $0.7985/¥100.(The contractual size of one CME Yen contract is ¥12,500,000) .If you have a short position in one futures contract,the changes in the margin account from daily marking-to-market will result in the balance of the margin account after the third day to be

A) $1,425.

B) $2,000.

C) $2,325.

D) $3,425.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which equation is used to define the futures price?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

E) ![]()

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For European currency options written on euro with a strike price in dollars,what of the effect of an increase in r$ relative to r€?

A) Decrease the value of calls and puts ceteris paribus

B) Increase the value of calls and puts ceteris paribus

C) Decrease the value of calls, increase the value of puts ceteris paribus

D) Increase the value of calls, decrease the value of puts ceteris paribus

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Find the cost today of your hedge portfolio in pounds.

Correct Answer

verified

Correct Answer

verified

Essay

Use your results from the last three questions to verify your earlier result for the value of the call.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the binomial option pricing model to find the value of a call option on £10,000 with a strike price of €12,500. The current exchange rate is €1.50/£1.00 and in the next period the exchange rate can increase to €2.40/£ or decrease to €0.9375/€1.00 . The current interest rates are i€ = 3% and are i£ = 4%. Choose the answer closest to yours.

A) €3,275

B) €2,500

C) €3,373

D) €3,243 ![]() And thereby the value call is

And thereby the value call is ![]()

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

If the call finishes in-the-money what is your replicating portfolio cash flow?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

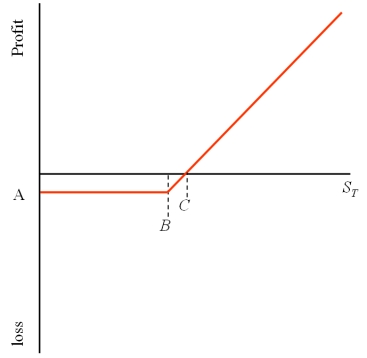

Consider the graph of a call option shown at right.The option is a three-month American call option on €62,500 with a strike price of $1.50 = €1.00 and an option premium of $3,125.What are the values of A,B,and C,respectively?

A) A = -$3,125 (or -$.05 depending on your scale) ; B = $1.50; C = $1.55

B) A = -€3,750 (or -€.06 depending on your scale) ; B = $1.50; C = $1.55

C) A = -$.05; B = $1.55; C = $1.60

D) none of the above

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 100

Related Exams