A) a unit of account

B) a store of value

C) medium of exchange

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) The president of the New York Fed gets to vote at every meeting of the Federal Open Market Committee,but this is not true of the presidents of the other regional Federal Reserve Banks.

B) The Fed's policy decisions influence the economy's rate of inflation in the short run and the economy's employment and production in the long run.

C) The Fed's primary tool of monetary policy is open-market operations.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The money supply increases when the Fed

A) buys bonds.The increase will be larger,the smaller is the reserve ratio.

B) buys bonds.The increase will be larger,the larger is the reserve ratio.

C) sells bonds.The increase will be larger,the smaller is the reserve ratio.

D) sells bonds.The increase will be larger,the larger is the reserve ratio.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the Fed requires banks to hold 10 percent of their deposits as reserves.A bank has $20,000 of excess reserves and then sells the Fed a Treasury bill for $9,000.How much does this bank now have to lend out if it decides to hold only required reserves?

A) $29,000

B) $28,100

C) $19,100

D) $11,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is included in M2 but not in M1?

A) currency

B) demand deposits

C) savings deposits

D) All of the above are included in both M1 and M2.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

An increase in reserve requirements increases reserves and decreases the money supply.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In December 1999 people feared that there might be computer problems at banks as the century changed.Consequently,people wanted to hold relatively more in currency and relatively less in deposits.In anticipation banks raised their reserve ratios to have enough cash on hand to meet depositors' demands.These actions by the public

A) would increase the multiplier.If the Fed wanted to offset the effect of this on the size of the money supply,it could have sold bonds.

B) would increase the multiplier.If the Fed wanted to offset the effect of this on the size of the money supply,it could have bought bonds.

C) would reduce the multiplier.If the Fed wanted to offset the effect of this on the size of the money supply,it could have sold bonds.

D) would reduce the multiplier.If the Fed wanted to offset the effect of this on the size of the money supply,it could have bought bonds.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Federal Deposit Insurance Corporation

A) protects depositors in the event of bank failures.

B) has become insolvent in recent years due to a large number of bank failures.

C) is part of the Federal Reserve System.

D) in practice has seldom been of much use.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the reserve ratio is 4 percent,then $81,250 of new money can be generated by

A) $325 of new reserves.

B) $3,250 of new reserves.

C) $20,312.50 of new reserves.

D) $2,031,250 of new reserves.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If $300 of new reserves generates $800 of new money in the economy,then the reserve ratio is

A) 2.7 percent.

B) 12.5 percent.

C) 37.5 percent.

D) 40 percent.

F) A) and B)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

In 1991,the Federal Reserve lowered the reserve requirement ratio from 12 percent to 10 percent.Other things the same this should have

A) increased both the money multiplier and the money supply.

B) decreased both the money multiplier and the money supply.

C) increased the money multiplier and decreased the money supply.

D) decreased the money multiplier and increased the money supply.

F) A) and D)

Correct Answer

verified

A

Correct Answer

verified

True/False

In an economy that relies on barter,trade requires a double-coincidence of wants.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economists use the word "money" to refer to

A) income generated by the production of goods and services.

B) those assets regularly used to buy goods and services.

C) the value of a person's assets.

D) the value of stocks and bonds.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

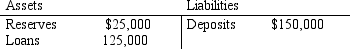

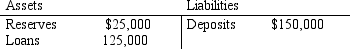

Table 29-4.

The First Bank of Wahooton

-Refer to Table 29-4.Suppose the bank faces a reserve requirement of 10 percent.Starting from the situation as depicted by the T-account,a customer deposits an additional $50,000 into his account at the bank.If the bank takes no other action it will

-Refer to Table 29-4.Suppose the bank faces a reserve requirement of 10 percent.Starting from the situation as depicted by the T-account,a customer deposits an additional $50,000 into his account at the bank.If the bank takes no other action it will

A) have $65,000 in excess reserves.

B) have $55,000 in excess reserves.

C) need to raise an additional $5,000 of reserves to meet the reserve requirement

D) None of the above is correct.

F) B) and C)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Scenario 29-1. The monetary policy of Salidiva is determined by the Salidivian Central Bank.The local currency is the salido.Salidivian banks collectively hold 100 million salidos of required reserves,25 million salidos of excess reserves,250 million salidos of Salidivian Treasury Bonds,and their customers hold 1,000 million salidos of deposits.Salidivians prefer to use only demand deposits and so the money supply consists of demand deposits. -Refer to Scenario 29-1.Assuming the only other item Salidivian banks have on their balance sheets is loans,what is the value of existing loans made by Salidivian banks?

A) 625 million salidos

B) 875 million salidos

C) 1,125 million salidos

D) None of the above is correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The double coincidence of wants

A) is required when there is no item in an economy that is widely accepted in exchange for goods and services.

B) is required in an economy that relies on barter.

C) is a hindrance to the allocation of resources when it is required for trade.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

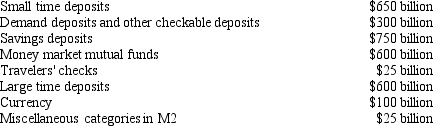

Given the following information,what are the values of M1 and M2?

A) M1 = $400 billion,M2 = $2,475 billion.

B) M1 = $125 billion,M2 = $3,025 billion.

C) M1 = $425 billion,M2 = $2,450 billion.

D) M1 = $425 billion,M2 = $1,875 billion.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At any meeting of the Federal Open Market Committee,that committee's voting members consist of

A) 5 Federal Reserve Regional Bank Presidents and all the members of the Board of Governors.

B) 5 Federal Reserve Regional Bank Presidents and 5 members of the Board of Governors.

C) 12 Federal Reserve Regional Bank Presidents and all the members of the Board of Governors.

D) 12 Federal Reserve Regional Bank Presidents and 5 members of the Board of Governors.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a fractional-reserve banking system with no excess reserves and no currency holdings,if the central bank buys $100 million of bonds,

A) reserves and the money supply increase by less than $100 million.

B) reserves increase by $100 million and the money supply increases by $100 million.

C) reserves increase by $100 million and the money supply increases by more than $100 million.

D) both reserves and the money supply increase by more than $100 million.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 29-4.

The First Bank of Wahooton

-Refer to Table 29-4.If the bank faces a reserve requirement of 10 percent,then the bank

-Refer to Table 29-4.If the bank faces a reserve requirement of 10 percent,then the bank

A) is in a position to make a new loan of $15,000.

B) has fewer reserves than are required.

C) has excess reserves of $10,000.

D) None of the above is correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 366

Related Exams