A) consumer surplus after the tax.

B) consumer surplus before the tax.

C) producer surplus after the tax.

D) producer surplus before the tax.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

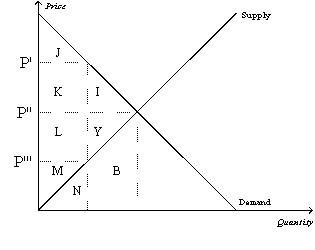

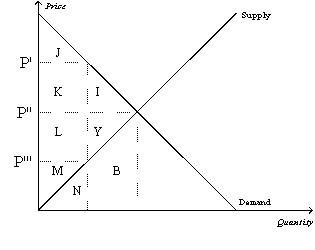

Figure 8-1  -Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The area measured by J+K+L+M represents

-Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The area measured by J+K+L+M represents

A) total surplus after the tax.

B) total surplus before the tax.

C) deadweight loss from the tax.

D) tax revenue.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deadweight loss measures the loss

A) in a market to buyers and sellers that is not offset by an increase in government revenue.

B) in revenue to the government when buyers choose to buy less of the product because of the tax.

C) of equality in a market due to government intervention.

D) of total revenue to business firms due to the price wedge caused by the tax.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

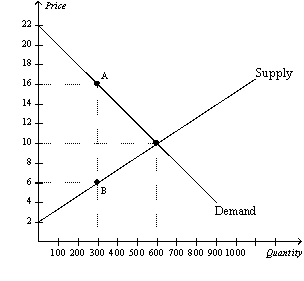

Figure 8-2

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-2.The loss of consumer surplus for those buyers of the good who continue to buy it after the tax is imposed is

-Refer to Figure 8-2.The loss of consumer surplus for those buyers of the good who continue to buy it after the tax is imposed is

A) $0.

B) $1.50.

C) $3.

D) $4.50.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

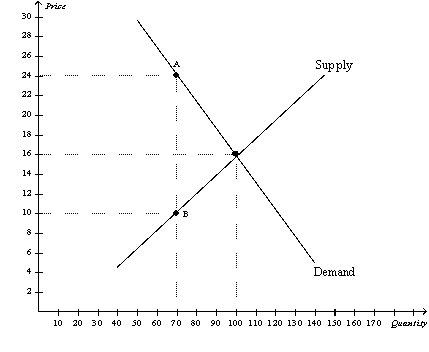

Figure 8-6

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-6.When the tax is imposed in this market,producer surplus is

-Refer to Figure 8-6.When the tax is imposed in this market,producer surplus is

A) $450.

B) $600.

C) $900.

D) $1,500.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The size of the deadweight loss generated from a tax is affected by the

A) elasticities of both supply and demand.

B) elasticity of demand only.

C) elasticity of supply only.

D) total revenue collected by the government.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The deadweight loss from a $3 tax will be largest in a market with

A) inelastic supply and elastic demand.

B) inelastic supply and inelastic demand.

C) elastic supply and elastic demand.

D) elastic supply and inelastic demand.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

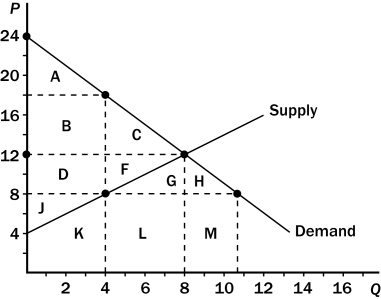

Figure 8-8

Suppose the government imposes a $10 per unit tax on a good.  -Refer to Figure 8-8.One effect of the tax is to

-Refer to Figure 8-8.One effect of the tax is to

A) reduce consumer surplus by $36.

B) reduce producer surplus by $24.

C) create a deadweight loss of $20.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Taxes on labor tend to encourage second earners to stay at home rather than work in the labor force.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-4

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-4.The tax results in a loss of consumer surplus that amounts to

-Refer to Figure 8-4.The tax results in a loss of consumer surplus that amounts to

A) $120.

B) $240.

C) $560.

D) $680.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

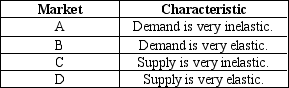

Table 8-1

-Refer to Table 8-1.Suppose the government is considering levying a tax in one or more of the markets described in the table.Which of the markets will allow the government to minimize the deadweight loss(es) from the tax?

-Refer to Table 8-1.Suppose the government is considering levying a tax in one or more of the markets described in the table.Which of the markets will allow the government to minimize the deadweight loss(es) from the tax?

A) market A only

B) markets A and C only

C) markets B and D only

D) market C only

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Anger over British taxes played a significant role in bringing about the

A) election of John Adams as the second American president.

B) American Revolution.

C) War of 1812.

D) "no new taxes" clause in the U.S.Constitution.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the tax on gasoline is raised from $0.50 per gallon to $2.50 per gallon.As a result,

A) tax revenue necessarily increases.

B) the deadweight loss of the tax necessarily increases.

C) the supply curve for gasoline necessarily becomes steeper.

D) All of the above are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the supply curve for cigars is a typical,upward-sloping straight line,and the demand curve for cigars is a typical,downward-sloping straight line.Suppose the equilibrium quantity in the market for cigars is 1,000 per month when there is no tax.Then a tax of $0.50 per cigar is imposed.The effective price paid by buyers increases from $1.50 to $1.90 and the effective price received by sellers falls from $1.50 to $1.40.The government's tax revenue amounts to $475 per month.Which of the following statements is correct?

A) After the tax is imposed,the equilibrium quantity of cigars is 900 per month.

B) The demand for cigars is more elastic than the supply of cigars.

C) The deadweight loss of the tax is $12.50.

D) The tax causes a decrease in consumer surplus of $380.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-1  -Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The consumer surplus after the tax is measured by the area

-Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The consumer surplus after the tax is measured by the area

A) J+K+I.

B) J.

C) M.

D) L+M+Y.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the supply of land is fixed,the burden of a tax on land falls

A) partly on landowners and partly on users of land.

B) entirely on the renters or users of land.

C) entirely on workers.

D) entirely on landowners.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which of the following cases is it most likely that an increase in the size of a tax will decrease tax revenue?

A) The price elasticity of demand is small,and the price elasticity of supply is large.

B) The price elasticity of demand is large,and the price elasticity of supply is small.

C) The price elasticity of demand and the price elasticity of supply are both small.

D) The price elasticity of demand and the price elasticity of supply are both large.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-2

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-2.Consumer surplus without the tax is

-Refer to Figure 8-2.Consumer surplus without the tax is

A) $6,and consumer surplus with the tax is $1.50.

B) $6,and consumer surplus with the tax is $4.50.

C) $10,and consumer surplus with the tax is $1.50.

D) $10,and consumer surplus with the tax is $4.50.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

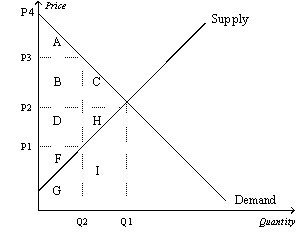

Figure 8-5

Suppose that the government imposes a tax of P3 - P1.  -Refer to Figure 8-5.The equilibrium price before the tax is imposed is

-Refer to Figure 8-5.The equilibrium price before the tax is imposed is

A) P1.

B) P2.

C) P3.

D) P4.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Taxes cause deadweight losses because they prevent buyers and sellers from realizing some of the gains from trade.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 353

Related Exams