B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

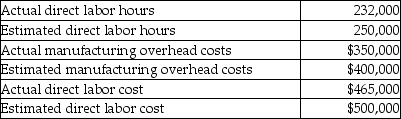

Nadal Company is debating the use of direct labor cost or direct labor hours as the cost allocation base for allocating manufacturing overhead. The following information is available for the most recent year:  If Nadal Company uses direct labor cost as the allocation base, what would the allocated manufacturing overhead be for the year?

If Nadal Company uses direct labor cost as the allocation base, what would the allocated manufacturing overhead be for the year?

A) $325,500

B) $372,000

C) $701,509

D) $400,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of overallocation or underallocation should be reflected as an adjustment to cost of goods sold under what circumstances?

A) In all circumstances

B) If most of the inventory produced during the period has not been sold

C) If most of the inventory produced during the period has been sold

D) Under no circumstance

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To record direct labor costs incurred, which of the following would be debited?

A) Finished goods inventory

B) Manufacturing overhead

C) Work in process inventory

D) Wages payable

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

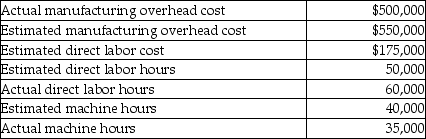

Hilltop Manufacturing uses a predetermined manufacturing overhead rate based on direct labor hours to allocate manufacturing overhead to jobs. Selected data about the company's operations follows:  By how much was manufacturing overhead overallocated or underallocated for the year?

By how much was manufacturing overhead overallocated or underallocated for the year?

A) $50,000 underallocated

B) $160,000 overallocated

C) $100,000 underallocated

D) $50,000 overallocated

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead is overallocated if the amount

A) allocated during the period is greater than the actual amount incurred.

B) estimated for the period is less than the amount allocated.

C) estimated for the period is greater than the amount allocated.

D) allocated during the period is less than the actual amount incurred.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Davy Company had a beginning work in process inventory balance of $32,000. During the year, $54,500 of direct materials was placed into production. Direct labor was $63,400, and indirect labor was $19,500. Manufacturing overhead is allocated at 125% of direct labor costs. Actual manufacturing overhead was $86,500, and jobs costing $225,000 were completed during the year. What is the ending work in process inventory balance?

A) $172,400

B) $11,400

C) $4,150

D) $79,250

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If manufacturing overhead has been underallocated during the period, then which of the following is true?

A) The jobs produced during the period have been overcosted.

B) The jobs produced during the period have been costed correctly.

C) The jobs produced during the period have been undercosted.

D) None of the above

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

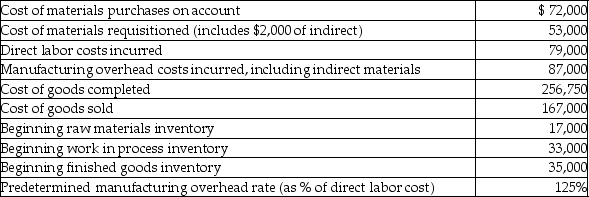

Here is some basic data for Shannon Company:  The journal entry to record the cost of raw materials placed into production involves a

The journal entry to record the cost of raw materials placed into production involves a

A) debit to overhead for $51,000.

B) debit to work in process inventory for $53,000.

C) debit to work in process inventory for $51,000.

D) credit to manufacturing overhead for $2,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

London Ceramics makes custom ceramic tiles. During March, the company started and finished Job #266. Job #266 consists of 2,500 tiles; each tile sells for $12.00. The company's records show the following direct materials were requisitioned for Job #266. Basic terra cotta tiles: 2,500 units at $4.00 per unit Specialty paint: 5 quarts at $7.00 per quart High gloss glaze: 4 quarts at $12.00 per quart Labor time records show the following employees worked on Job #266: Alice Cooper: 18 hours at $24 per hour Matthew Kline: 20 hours at $13 per hour Sierra Ceramics allocates manufacturing overhead at a rate of $27 per direct labor hour. What is the total amount of direct materials, direct labor, and manufacturing overhead that should be shown on Job #266's job cost record?

A) $10,775

B) $1,026

C) $30,000

D) $11,801

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nemec Manufacturing uses job costing. In May, material requisitions were $44,000 ($39,000 of these were direct materials) , and raw material purchases were $60,000. The end of month balance in raw materials inventory was $24,300. What was the beginning raw materials inventory balance?

A) $74,700

B) $45,300

C) $8,300

D) $23,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Determining how much manufacturing overhead is overallocated or underallocated

A) is done before the period starts.

B) is done during the period.

C) can be done at any time.

D) is done at the end of the period.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Job 123 requires $12,000 of direct materials, $5,500 of direct labor, 500 direct labor hours, and 300 machine hours. It also requires 6 hours of inspection at $40 per hour. Manufacturing overhead is computed at $30 per direct labor hour used and $40 per machine hour used. The total amount charged for inspection

A) is $40.

B) is $40 × budgeted hours.

C) is $240.

D) does not figure into the total cost of the job.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead has an underallocated balance of $6,200; raw materials inventory balance is $50,000; work in process inventory is $30,000; finished goods inventory is $20,000; and cost of goods sold is $100,000. Using this information, which account would have an opening credit balance?

A) Raw materials inventory

B) Finished goods inventory

C) Work in process inventory

D) None of the above

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To record the requisition of direct materials, which of the following would be debited?

A) Finished goods inventory

B) Work in process inventory

C) Raw materials inventory

D) Cost of goods manufactured

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between the sales price and the job cost is

A) gross profit.

B) cost of goods sold.

C) net income.

D) operating income.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

At a service company, the indirect costs of serving the client consists of operating expenses.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

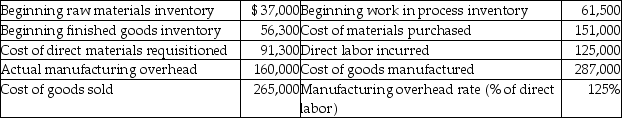

Here are selected data for Sally Day Corporation:  What is the ending work in process inventory balance?

What is the ending work in process inventory balance?

A) $147,050

B) $151,500

C) $211,200

D) $207,450

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To allocate manufacturing overhead to specific jobs, the needed journal entry would include a

A) credit to work in process inventory.

B) debit to manufacturing overhead.

C) debit to cost of goods sold.

D) credit to manufacturing overhead.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A job costing system can be used by which types of companies?

A) Manufacturing and merchandising businesses

B) Service and manufacturing businesses

C) Service, manufacturing, and merchandising businesses

D) Service and merchandising businesses

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 334

Related Exams