A) affects the distribution of domestic output and income but not its total size.

B) is shown as some point outside of an economy's production possibilities curve.

C) places the economy at some point inside of its production possibilities curve.

D) affects the total size of domestic output and income but not its distribution.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

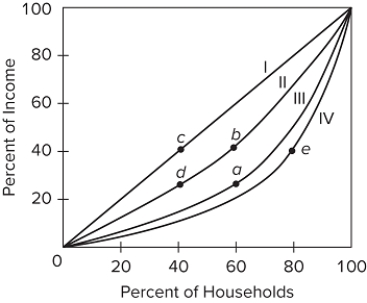

Refer to the figure, which shows four different Lorenz curves (I, II, III, and IV) . The movement from point b to point a in the graph would indicate that the

Refer to the figure, which shows four different Lorenz curves (I, II, III, and IV) . The movement from point b to point a in the graph would indicate that the

A) lower 40 percent of households increased their share of total income from 25 percent to 40 percent.

B) lower 40 percent of households decreased their share of total income from 60 percent to 40 percent.

C) lower 60 percent of households decreased their share of total income from 40 percent to 25 percent.

D) lower 40 percent of households increased their share of total income from 40 percent to 60 percent.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the market wage rate for whites is $18 an hour and the monetary value a prejudiced employer attaches to the disutility of hiring African Americans is $3. This employer will be indifferent between hiring African Americans and whites only when the African-American wage rate is

A) $3.

B) $12.

C) $15.

D) $21.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two major criticisms of the Bureau of Census data as a portrayal of the degree of income inequality are that the income concept employed is too

A) broad and the income accounting period is too short.

B) narrow and the income accounting period is too long.

C) narrow and the income accounting period is too short.

D) broad and the income accounting period is too long.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following groups would we expect to have the highest poverty rate?

A) Hispanic married households

B) elderly Asian households

C) white households headed by females

D) African-American households headed by females

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the members of population A, consisting of Al, Bob, Curt, Doris, and Ellie, receive annual incomes of $5,000, $4,000, $3,000, $2,000, and $1,000, respectively. What percentage of total income is received by the fourth quintile?

A) 26.7

B) 20

C) 33.3

D) 16.7

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the taste for discrimination model, the perceived cost for a prejudiced white employer for hiring an African-American worker is

A) the ratio of the wages of African-American workers to white workers.

B) the ratio of the wages of white workers to African-American workers.

C) the wages of African-American workers plus the monetary value of the disutility from hiring an African-American worker.

D) the wages of a white worker plus the monetary value of the disutility from hiring an African-American worker.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following Gini ratios indicates the lowest degree of income inequality?

A) 0.31

B) 0.71

C) 0.55

D) 0.45

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wealth in the United States is

A) distributed in a way that reduces the degree of income inequality.

B) more unequally distributed than is income.

C) less unequally distributed than is income.

D) distributed in a way that has no effect on income inequality.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements applies to the Social Security program?

A) Benefits are paid on the basis of need.

B) It provides cash assistance and services to families with dependent children.

C) It is financed by payroll taxes on employees and employers.

D) Benefit levels vary throughout the nation because the system is administered by the individual states.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that all workers are equally productive, but the wage rate for men is $12, compared to $9 for women. An employer who employs only male workers must have a discrimination coefficient of

A) more than $3.

B) at most 0.3.

C) less than $3.

D) 1.33 or less.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

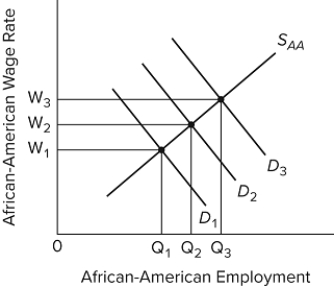

Refer to the diagram. Which of the following would be consistent with an increase in racial prejudice against African Americans and thus an increase in the discrimination coefficients of employers, taken as a group?

Refer to the diagram. Which of the following would be consistent with an increase in racial prejudice against African Americans and thus an increase in the discrimination coefficients of employers, taken as a group?

A) a shift in the labor demand curve from D₂ to D₃

B) a shift in the labor demand curve from D₂ to D₁

C) an increase in African-American employment from Q₂ to Q₃

D) an increase in the African-American wage rage from W₁ to W₂

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of the provisions of the Temporary Assistance for Needy Families (TANF) program was to

A) guarantee cash assistance for poor families.

B) set a 5-year lifelong limit on welfare benefits.

C) get the federal government to pay more of the cost of welfare.

D) make welfare benefits more equitable among those receiving them.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would most likely increase income inequality?

A) improvements in public education

B) greater monopoly power among product sellers

C) greater equality in the distribution of wealth

D) fewer differences in working conditions across occupations

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

About a quarter of all U.S. households had personal incomes of $100,000 or more in 2017.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

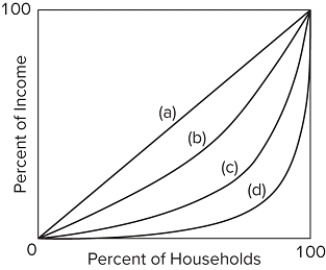

Refer to the graph. If the Lorenz curve shifted from (d) to (b) , then the Gini ratio and the degree of income inequality would

Refer to the graph. If the Lorenz curve shifted from (d) to (b) , then the Gini ratio and the degree of income inequality would

A) increase.

B) decrease.

C) remain constant.

D) become negative.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Standard census data on the distribution of income

A) take all taxes and transfer payments into account.

B) are before taxes in that they do not account for personal income and payroll taxes.

C) include noncash transfers.

D) exclude cash transfers.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2017, a household with an annual income of $23,000 would find itself in the

A) highest quintile of the household income distribution.

B) second quintile of the household income distribution.

C) lowest quintile of the household income distribution.

D) fourth quintile of the household income distribution.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2017, the fourth quintile of households in the U.S. income distribution received about

A) 27 percent of total income.

B) 35 percent of total income.

C) 43 percent of total income.

D) 23 percent of total income.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the quintile distribution of income, the term "quintile" represents

A) 5 percent of the income receivers.

B) 10 percent of the income receivers.

C) 20 percent of the income receivers.

D) 25 percent of the income receivers.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 324

Related Exams