A) liquidity

B) real return

C) government budget deficits

D) none of the above

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A decrease in the money supply leads to an initial increase but a long-run decrease in the equilibrium interest rate if the _____ effect dominates other effects.

A) liquidity

B) price level

C) expected inflation

D) none of the above

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Stocks are perceived to be riskier. Explain how bond yields would be affected.

Correct Answer

verified

The relative risk of bonds wou...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

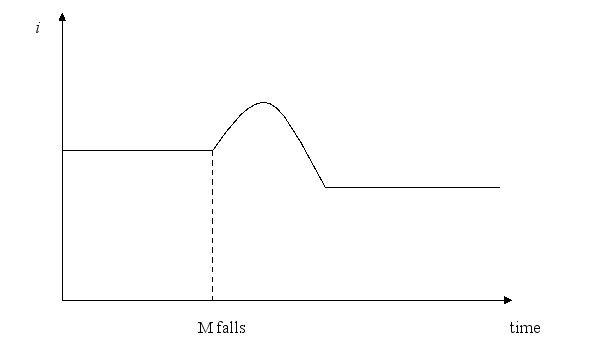

Use a graph of the interest rate against time to explain the effect of a decrease in the money supply when the liquidity effect is weaker the other effects.

Correct Answer

verified

The liquidity effect causes an initial i...View Answer

Show Answer

Correct Answer

verified

View Answer

Multiple Choice

What are the reasons for the general fall in interest rates between 1920 and World War II?

A) poor business conditions and low confidence in public policies

B) high taxes and stringent government regulations

C) an increase in the demand for bonds

D) an increase in the supply of bonds

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The supply of bonds shifts to the right with an increase in expected inflation, since inflation reduces burden of borrowing.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inflation affects the equilibrium yield on bonds due to its impact on

A) the demand for bonds.

B) the supply of bonds.

C) the supply and demand for bonds.

D) none of the above

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If the interest rate rises, people will want to hold fewer bonds, meaning the demand for money shifts to the right.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Corporations issue more bonds when

A) their stocks are publicly traded.

B) the government runs a deficit.

C) they perceive opportunities for profitable expansion.

D) all of the above.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If the interest rate falls, people will want to hold more bonds, meaning the demand for money shifts to the left.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

When inflation expectations rise, what happens to the demand, and how does the demand curve shift?

Correct Answer

verified

The demand goes down...View Answer

Show Answer

Correct Answer

verified

View Answer

Multiple Choice

Which of the following affect(s) the demand for bonds?

A) real rate of return

B) household wealth

C) liquidity

D) all of the above

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

An economic expansion can lead to higher equilibrium bond yields.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 73 of 73

Related Exams