A) tax consumers.

B) offer consumers a subsidy.

C) place a quota at the efficient level.

D) All of these are options the government can take to help a market reach efficiency.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the Coase theorem, a private solution to an externality yields a(n) _______ efficient outcome compared to a government solution.

A) more

B) less

C) equally

D) None of these are true.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

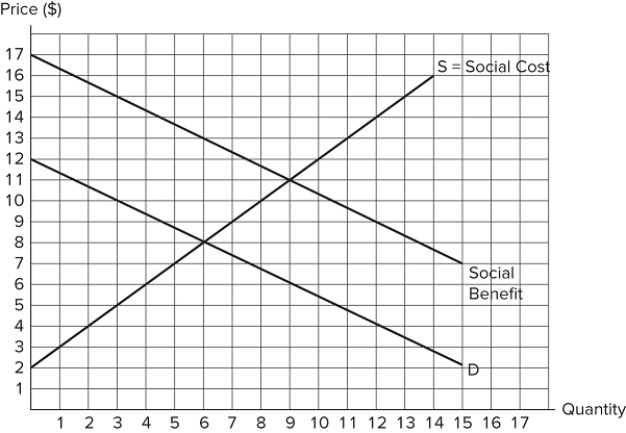

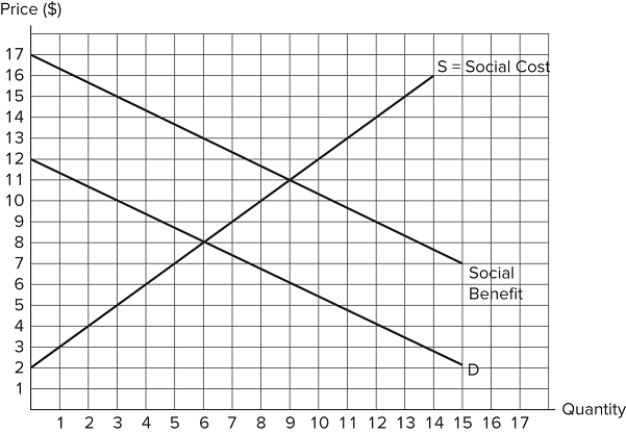

The graph shown displays a market with an externality.  This is a _______ externality, and the optimal quantity is _______ units.

This is a _______ externality, and the optimal quantity is _______ units.

A) positive; 6

B) positive; 8

C) negative; 6

D) negative; 8

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the revenues from a Pigovian tax are not directed to those who are affected by the externality, the outcome will _______ and will _______ surplus.

A) be efficient; maximize

B) not be efficient; not maximize

C) be efficient; not maximize

D) not be efficient; maximize

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

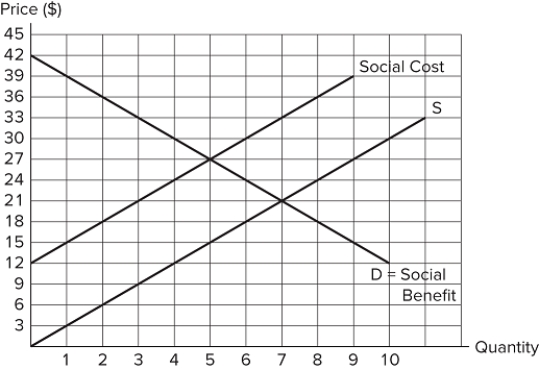

The graph shown displays a market with an externality.  Which of the following statements is true? A tax of $12 per unit would eliminate deadweight loss.The government should use a subsidy to counteract this externality.If the government does not intervene, deadweight loss will be $0.

Which of the following statements is true? A tax of $12 per unit would eliminate deadweight loss.The government should use a subsidy to counteract this externality.If the government does not intervene, deadweight loss will be $0.

A) I and II only

B) I only

C) II only

D) II and III only

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

External benefits accrue:

A) directly to the decision maker of a market exchange.

B) indirectly to the decision maker of a market exchange.

C) without compensation to someone other than the person who caused them.

D) to the government without its direct intervention.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a positive consumption externality were present in a market, the social benefit curve would be:

A) below the private demand curve.

B) above the private demand curve.

C) identical to the private demand curve.

D) The social benefit curve's location cannot be determined without more information.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When tradable allowances are used to correct a negative externality in a market, the outcome:

A) limits the quantity bought and sold to the efficient level.

B) maximizes surplus.

C) is efficient.

D) All of these are true.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The distribution of surplus gained when private parties solve an externality problem on their own, under the Coase theorem, is dependent on:

A) which party has more power to enforce the solution.

B) which party has more negotiating power or wealth.

C) where the initial rights of the parties lie.

D) None of these are true.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a positive externality is present in a market, total surplus will be _______ if buyers only consider _______ costs.

A) higher; private

B) lower; private

C) lower; social

D) unchanged; social

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Coase theorem will hold only if: people can make enforceable agreements. there are very low or no transactions costs. people are altruistic.

A) I only

B) II and III only

C) I and II only

D) I, II, and III

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When positive externalities exist in a market, if a subsidy is imposed:

A) those who interact in the market will lose surplus.

B) those who interact in the market will gain surplus.

C) those who do not interact in the market, but are affected by the externality, will gain surplus.

D) None of these are necessarily true.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

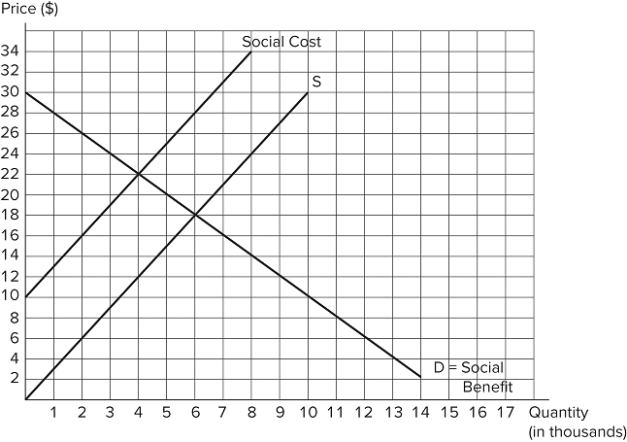

The graph shown displays a market with an externality.  Which of the following statements is true?The efficient quantity is 6 units.This shows a negative production externality.The size of the externality is $4 per unit.

Which of the following statements is true?The efficient quantity is 6 units.This shows a negative production externality.The size of the externality is $4 per unit.

A) I and III only

B) II only

C) I only

D) I, II, and III

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

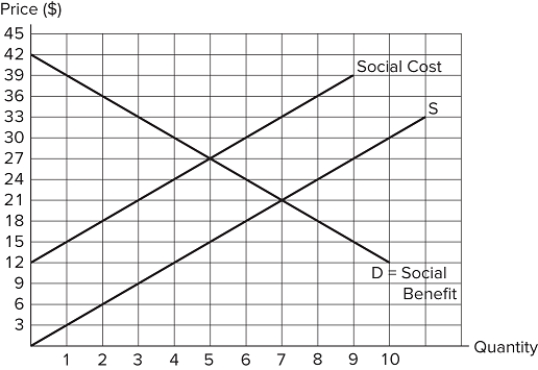

The graph shown displays a market with an externality.  Which of the following statements is true?This shows a negative consumption externality.The efficient quantity is 7 units.The size of the externality is $12 per unit.

Which of the following statements is true?This shows a negative consumption externality.The efficient quantity is 7 units.The size of the externality is $12 per unit.

A) I and III only

B) III only

C) II only

D) I, II, and III

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is imposed on a market with a negative externality, the market is:

A) inefficient, because the net benefit of buying another unit is zero for all market participants.

B) efficient, because the net benefit of buying another unit is zero for all market participants.

C) efficient, because the government mandates the efficient quantity without regard for net benefits.

D) inefficient, because the government mandates the tax without regard for net benefits.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a negative production externality is present in a market:

A) private costs are less than social costs.

B) private costs are less than external costs.

C) social costs are less than external costs.

D) external costs are equal to social costs.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The graph shown displays a market with an externality.  The external _______ is _______.

The external _______ is _______.

A) cost; $3

B) cost; $5

C) benefit; $3

D) benefit; $5

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The effect that an additional user of a good or participant in an activity has on the value of that good or activity for others is called a _______ externality.

A) network

B) social

C) negative

D) private

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economists propose that a tax intended to correct for the presence of an externality should be based on:

A) the action that creates the externality, rather than the externality itself.

B) the externality itself, rather than the action that creates it.

C) what is simplest to implement.

D) what will likely generate the most revenue.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Any cost that is imposed without compensation on someone other than the person who caused it is called a(n) _______ cost.

A) private

B) social

C) external

D) network

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 131

Related Exams