B) False

Correct Answer

verified

Correct Answer

verified

True/False

The average accounts receivable balance is a function of both the volume of credit sales and the days sales outstanding.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Accruals are "free" capital in the sense that no explicit interest must normally be paid on accrued liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Depreciation is included in the estimate of cash flows (Cash flow = Net income + Depreciation) , hence depreciation is set forth on a separate line in the cash budget.

B) If cash inflows from collections occur in equal daily amounts but most payments must be made on the 10th of each month, then a regular monthly cash budget will be misleading. The problem can be corrected by using a daily cash budget.

C) Sound working capital policy is designed to maximize the time between cash expenditures on materials and the collection of cash on sales.

D) If a firm wants to generate more cash flow from operations in the next month or two, it could change its credit policy from 2/10 net 30 to net 60.

E) If a firm sells on terms of net 90, and if its sales are highly seasonal, with 80% of its sales in September, then its DSO as it is typically calculated (with sales per day = Sales for past 12 months/365) would probably be lower in October than in August.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most consistent with efficient inventory management? The firm has a

A) below average inventory turnover ratio.

B) low incidence of production schedule disruptions.

C) below average total assets turnover ratio.

D) relatively high current ratio.

E) relatively low DSO.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A firm constructing a new manufacturing plant and financing it with short-term loans, which are scheduled to be converted to first mortgage bonds when the plant is completed, would want to separate the construction loan from its current liabilities associated with working capital when calculating net working capital.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Since depreciation is a non-cash charge, it neither appears on nor has any effect on the cash budget. Thus, if the depreciation charge for the coming year doubled or halved, this would have no effect on the cash budget.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Margetis Inc. carries an average inventory of $750,000. Its annual sales are $10 million, its cost of goods sold is 75% of annual sales, and its average collection period is twice as long as its inventory conversion period. The firm buys on terms of net 30 days, and it pays on time. Its new CFO wants to decrease the cash conversion cycle by 10 days, based on a 365-day year. He believes he can reduce the average inventory to $647,260 with no effect on sales. By how much must the firm also reduce its accounts receivable to meet its goal in the reduction of the cash conversion cycle?

A) $123,630

B) $130,137

C) $136,986

D) $143,836

E) $151,027

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Helena Furnishings wants to reduce its cash conversion cycle. Which of the following actions should it take?

A) Increase average inventory without increasing sales.

B) Take steps to reduce the DSO.

C) Start paying its bills sooner, which would reduce the average accounts payable but not affect sales.

D) Sell common stock to retire long-term bonds.

E) Sell an issue of long-term bonds and use the proceeds to buy back some of its common stock.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

On average, a firm collects checks totaling $250,000 per day. It takes the firm approximately 4 days from the day the checks were mailed until they result in usable cash for the firm. Assume that (1) a lockbox system could be employed which would reduce the cash conversion procedure to 2 1/2 days and (2) the firm could invest any additional cash generated at 6% after taxes. The lockbox system would be a good buy if it costs $25,000 annually.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

"Stretching" accounts payable is a widely accepted, entirely ethical, and costless financing technique.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Trade credit can be separated into two components: free trade credit, which is credit received after the discount period ends, and costly trade credit, which is the cost of discounts not taken.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When deciding whether or not to take a trade discount, the cost of borrowing from a bank or other source should be compared to the cost of trade credit to determine if the cash discount should be taken.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The facts (1) that no explicit interest is paid on accruals and (2) that the firm can control the level of these accounts at will makes them an attractive source of funding to meet working capital needs.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A firm's collection policy, i.e., the procedures it follows to collect accounts receivable, plays an important role in keeping its average collection period short, although too strict a collection policy can reduce profits due to lost sales.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following actions would be likely to shorten the cash conversion cycle?

A) Adopt a new manufacturing process that speeds up the conversion of raw materials to finished goods from 20 days to 10 days.

B) Change the credit terms offered to customers from 3/10 net 30 to 1/10 net 50.

C) Begin to take discounts on inventory purchases; we buy on terms of 2/10 net 30.

D) Adopt a new manufacturing process that saves some labor costs but slows down the conversion of raw materials to finished goods from 10 days to 20 days.

E) Change the credit terms offered to customers from 2/10 net 30 to 1/10 net 60.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inmoo Company's average age of accounts receivable is 45 days, the average age of accounts payable is 40 days, and the average age of inventory is 69 days. Assuming a 365-day year, what is the length of its cash conversion cycle?

A) 63 days

B) 67 days

C) 70 days

D) 74 days

E) 78 days

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

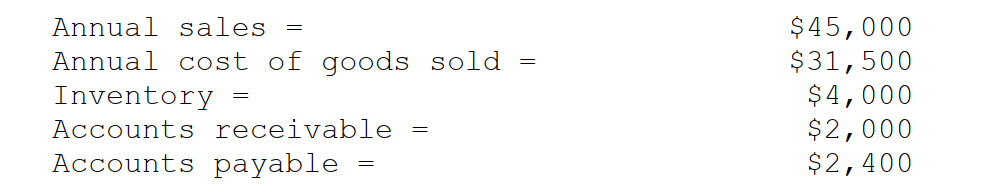

Dewey Corporation has the following data, in thousands. Assuming a 365-day year, what is the firm's cash conversion cycle?

A) 25 days

B) 28 days

C) 31 days

D) 35 days

E) 38 days

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

For a firm that makes heavy use of net float, being able to forecast collections and disbursement check clearings is essential.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

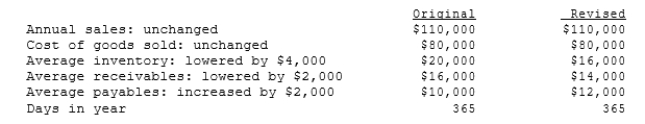

Desai Inc. has the following data, in thousands. Assuming a 365-day year, what is the firm's cash conversion cycle?

A) 28 days

B) 32 days

C) 35 days

D) 39 days

E) 43 days

G) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 129

Related Exams