Correct Answer

verified

Correct Answer

verified

Multiple Choice

The bank statement of July 31 for Savon Co. showed a balance of $6,008.10, and the checkbook showed a balance of $1,900.40. The bookkeeper of Savon Co. noticed from the bank statement that the bank had collected a note for $666.66. There was a deposit in transit made on July 1 for $1,100.10 along with the outstanding checks of $4,580.54. Check charges were $39.40. The reconciled balance is:

A) $5,227.66

B) $2,572.66

C) $2,527.66

D) $5,272.66

E) None of these

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A profit occurs when expenses exceed revenue.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A full endorsement is as safe as the restrictive endorsement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mia Wong's checking account had a balance of $3,100.55 on July 1. After looking at her bank statement, she noticed an NSF for $60.50, a service charge of $12.55, and a note collected for $600. There was one deposit in transit for $400 and no checks outstanding. What is the reconciled checkbook balance?

A) $3,527

B) $5,327.50

C) $3,627.50

D) $3,267.50

E) None of these

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Mobile banking is increasing today.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

All checks are required to have a preprinted check number.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

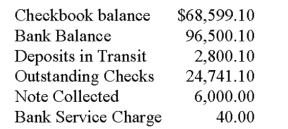

From the following the reconciled balance is:

A) $74,959.10

B) $47,959.10

C) $74,459.10

D) $74,359.10

E) None of these

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

On December 31, 200x, Brown Company's checkbook showed an $8,195.32 balance. Brown's bank statement showed a balance of $8,400.50. Check number 311 for $395.10 and check number 418 for $115.46 were outstanding. A $310.30 deposit was in transit. The bank charged a $10 service charge. The statement showed a $14.92 earned interest income. Complete Brown's bank reconciliation.

Correct Answer

verified

Correct Answer

verified

True/False

A check stub is completed after the check is written so records will be up to date.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

On Dec. 31 the checkbook balance of Aster Co. was $1,241.05. The bank statement balance was $1,510. Checks outstanding were $3,052.03. The statement revealed a deposit in transit of $2,800.10 as well as a bank service charge of $12.03. The company earned interest income of $29.05. Complete a bank reconciliation for Aster Co.

Correct Answer

verified

Correct Answer

verified

Short Answer

Bill Morse had a balance of $422.88 in his check register. The bank notified him that Alice Wrong had insufficient funds to cover her check that Bill deposited. The bank indicated that Bill's bank balance was being reduced. Bill felt that this was unfair since he never "bounces" his own checks. Is he justified? Please explain.

Correct Answer

verified

Correct Answer

verified

True/False

ATM's have completely replaced the need for tellers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On December 31 the checkbook balance of Ray Co. was $5,420.95. The bank statement balance showed $5,102.88. Checks outstanding totaled $813.53. The statement did not show a deposit in transit of $1,102.95. Check charges were $15.88. The company earned interest income of $29.32 that was shown on the report. The bookkeeper forgot to record a check for $42.09. The reconciled balance is:

A) $5,392.30

B) $5,923.03

C) $5,932.03

D) $5,392.03

E) None of these

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

All checking accounts earn interest.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An endorsement may be in writing or by the use of a company stamp.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Abe Frill received a bank statement from the Cloudy Bank indicating a balance of $12,000. Abe's checkbook showed a balance of $11,200. Deposits in transit were $2,000, and checks outstanding totaled $2,900. The bank service charge was $100. Complete the reconciliation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The checkbook balance of Roger Co. is $982.50. The bank statement reveals a balance of $1,051.82. The bank statement showed interest earned of $3.82 and a service charge of $15, along with a deposit in transit of $210. Outstanding checks totaled $270.50. The bookkeeper in further analyzing the bank statement noticed a collection of a note by the bank for $200. Roger Co. forgot to deduct a check for $180 during the month. The reconciled balance is:

A) $831.32

B) $991.32

C) $831.23

D) $991.23

E) None of these

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A blank endorsement is the safest type of endorsement.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A reconciled balance is found on the front side of a bank statement.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 70

Related Exams