B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2015, Valencia Company purchased equipment for $363,000 and also sold some special purpose machinery with a book value of $155,000 for $182,000.In its statement of cash flows for 2015, Valencia should report the following with respect to the above transactions:

A) $363,000 cash used by operating activities; $182,000 cash provided by financing activities.

B) $181,000 net cash used by investing activities.

C) $181,000 net cash used by investing activities; $27,000 net cash provided by operating activities.

D) $363,000 net cash used by investing activities.

F) A) and B)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

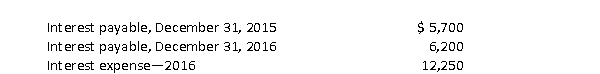

Tulsa Corp.reported the following information for 2015 and 2016.  How much cash was paid for interest during 2016?

How much cash was paid for interest during 2016?

A) $11,750

B) $12,250

C) $12,500

D) $12,750

F) A) and C)

Correct Answer

verified

A

Correct Answer

verified

True/False

Cash equivalents are reported in the Operating Activities section of the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

___________________________ is a noncash expense related to plant assets.

Correct Answer

verified

Correct Answer

verified

True/False

The work sheet used to prepare a statement of cash flows indirect method to determine cash flows from operating activities) should have a total in the Changes column equal to total assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the statement of cash flows is true?

A) The statement of cash flows analyzes the changes in consecutive balance sheets in conjunction with the income statement.

B) The statement of cash flows is organized as cash inflows less cash outflows.

C) The statement of cash flows analyzes only the changes in current assets and current liabilities.

D) The statement of cash flows is an optional financial statement.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

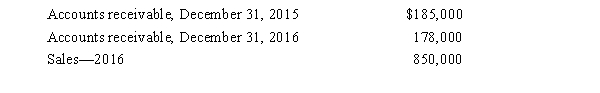

The following items were reported on the balance sheets and income statement for Carlton Co.:  What amount would be reported in the operating activities section of the statement of cash flows for collections from customers under the direct method assuming that all sales are on credit?

What amount would be reported in the operating activities section of the statement of cash flows for collections from customers under the direct method assuming that all sales are on credit?

A) $850,000

B) $857,000

C) $843,000

D) Cannot be determined without further information.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which method of preparing the operating activities section of a statement of cash flows reports major classes of gross cash receipts and cash payments for revenues and expenses?

A) The direct method

B) The indirect method

C) Both the direct method and the indirect method

D) Neither the direct method nor the indirect method

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If the December 31, 2016, balance of accounts receivable is higher than the January 1, 2016, balance, then the amount of cash collections will be less than the sales on account for the year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rent expense in Volusia Company's 2016 income statement is $420,000.If Prepaid Rent was $70,000 at December 31, 2015, and is $95,000 at December 31, 2016, the cash paid for rent during 2016 is:

A) $480,000

B) $445,000

C) $395,000

D) $420,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The statement of cash flows

A) along with the balance sheet and income statement is prepared on the accrual basis.

B) along with the balance sheet and statement of retained earnings is dated as of a specific year end date.

C) along with the balance sheet is used to analyze liquidity.

D) ties the balance sheet to the statement of retained earnings.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which method of preparing the operating activities section of a statement of cash flows adjusts net income to remove the effects of deferrals and accruals for revenues and expenses?

A) The direct method

B) The indirect method

C) Both the direct and indirect methods

D) Neither the direct method nor the indirect method

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blecher Co.reported the following information at the end of 2015 and 2016:  An analysis of Blecher's records indicated that there were no cash flow effects resulting from the changes in the two accounts presented above.How should Blecher report the changes in these accounts on a statement of cash flows?

An analysis of Blecher's records indicated that there were no cash flow effects resulting from the changes in the two accounts presented above.How should Blecher report the changes in these accounts on a statement of cash flows?

A) Blecher should report $65,000 for the acquisition of land as an investing activity and $65,000 for the issuance of stock as a financing activity.

B) Blecher should report $65,000 as a noncash investing and financing activity for the acquisition of land by issuing common stock.

C) Blecher should report the issuance of common stock to acquire land in the financing activity section with a net cash flow effect of zero.

D) Blecher should report the acquisition of land by issuing common stock in the investing activity section with a net cash flow effect of zero

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nordic Exports Inc.reported net income of $150,000 for 2015, but its cash balance decreased $40,000.Which financial statement should Nordic Exports' management refer to for an explanation of this situation?

A) Balance Sheet

B) Income Statement

C) Statement of Retained Earnings

D) Statement of Cash Flows

F) A) and D)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

When using the direct method, how is the issuance of stock for cash shown on the statement of cash flows?

A) Operating activity

B) Investing activity

C) Financing activity

D) Noncash investing and financing activity

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Significant noncash transactions are not reported on the statement of cash flows, but either in a separate schedule or in a note to the financial statements.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

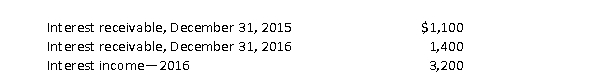

Dallas Corp.reported the following information for 2015 and 2016.  How much cash was received for interest during 2016?

How much cash was received for interest during 2016?

A) $2,900

B) $3,200

C) $3,500

D) $3,800

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

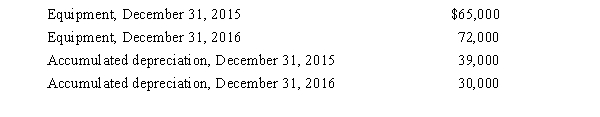

Use the information below for Shorter Inc.for 2015 and 2016 to answer the following question.  During 2016, Shorter Inc.sold equipment with a cost of $30,000 and accumulated depreciation of $25,000.A gain of $3,000 was recognized on the sale of the equipment This was the only equipment sale during the year.

Assume that all purchases of equipment were paid with cash.How much cash was paid by Shorter for the purchase of equipment during 2016?

During 2016, Shorter Inc.sold equipment with a cost of $30,000 and accumulated depreciation of $25,000.A gain of $3,000 was recognized on the sale of the equipment This was the only equipment sale during the year.

Assume that all purchases of equipment were paid with cash.How much cash was paid by Shorter for the purchase of equipment during 2016?

A) $ 7,000

B) $30,000

C) $37,000

D) $72,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary purpose of the statement of cash flows is to provide information about

A) the financial position of the company.

B) the profitability of the company.

C) the investing and financing activities of the company.

D) the cash inflows and outflows of the company.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 158

Related Exams