A) debit Interest Expense for $3,000 and credit Interest Payable for $3,000.

B) debit Cash for $3,000 and credit Accrued Interest for $3,000.

C) debit Interest Expense for $6,000 and credit Cash for $6,000.

D) debit Interest Expense for $6,000 and credit Notes Payable for $6,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

No disclosure is required for contingent liabilities that are

A) probable.

B) remote.

C) possible.

D) likely.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following must be paid by both the employee and the employer?

A) FICA taxes

B) State unemployment tax

C) State withholding tax

D) Federal unemployment tax

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company issues a 5-year bond with a $7,500 discount. Using straight-line amortization, the company should:

A) debit discount on bonds payable for $1,500 per year.

B) credit discount on bonds payable for $1,500 per year.

C) debit interest payable for $1,500 per year.

D) credit interest payable for $1,500 per year.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company sells a bond with a face value of $10,000 and receives a premium of $800. Using Bonds Payable, net (shortcut method) , the company would make the following journal entry:

A) Debit Cash for $10,800 and credit Bonds Payable, net for $10,800.

B) Debit Cash for $10,800, credit Bonds Payable, net for $10,000, and credit Premium on Bond Payable for $800.

C) Debit Cash for $10,000, debit Interest Expense for $800, credit Bonds Payable, net for $10,000, and credit Premium on Bonds Payable for $800.

D) Debit Cash for $10,000, debit Interest Expense for $800, credit Bonds Payable for $10,000 and credit

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts could have a non-zero balance on a post-closing trial balance?

A) Dividends declared

B) Premium on bonds payable

C) Income tax expense

D) Interest expense

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A company's current liabilities are the total amount it currently owes at a single point in time.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

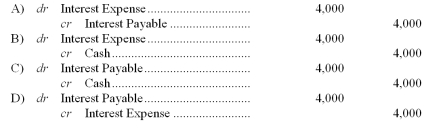

What adjusting entry should Backyard make on June 30 before preparing its annual financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your company issued bonds at a premium. Which of the following statements is NOT true?

A) The contra account, premium on bonds payable, is amortized each year by shifting part of its balance to interest expense.

B) On the date of issuance, the stated interest rate was greater than the market interest rate.

C) As the current date approaches the maturity date, the carrying value of the bond approaches the face value of the bond.

D) The account used to record the premium has a normal debit balance.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company encounters a contingent liability that is remote in likelihood, the company should:

A) include a description in the footnotes to the financial statements.

B) record the amount of the liability times the probability of its occurrence.

C) record the amount of the liability as a long-term liability on the balance sheet.

D) omit the information about the contingent liability from its financial statements and footnotes.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When bonds are retired, the balance in the bonds payable account is equal to the issuance price of the bonds.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Bonds allow a company to borrow a lot of money from a lot of different people.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The net amount of a bond payable on the balance sheet is the call price of the bond plus any related discount or minus any related premium.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the market rate of interest is 6%, a $10,000, 10-year bond with a stated annual interest rate of 8% would be issued at an amount:

A) less than face value.

B) equal to the face value.

C) greater than face value.

D) equal to the face value minus a discount.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The quick ratio is similar to the current ratio because it is also used to evaluate the ability to pay current liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How many of the following statements regarding amortization of discounts or premiums are true? Under straight-line amortization, when a bond is sold at a premium, the annual premium amortization is the total premium divided by the number of years until bond maturity. When a bond is sold at a discount, interest expense recorded using the effective-interest method is less than the Interest paid on the bond. The effective-interest method of amortization is considered to be conceptually superior to straight -line Amortization. When a bond premium is amortized using the effective-interest method, the promised interest payment is less Than the interest expense, so the bond liability will increase as a result of the contra-liability account decreasing.

A) One

B) Two

C) Three

D) Four

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

IBM is planning to issue $1,000 bonds with a stated interest rate of 7% and a maturity date of July 15, 2022. If interest rates rise in the economy so that similar financial investments pay 9%, IBM will:

A) not be able to issue the bonds because no one will buy them.

B) receive a higher issue price to compensate buyers for the lower stated interest rate.

C) have to accept a lower issue price to attract buyers.

D) have to reprint the bond certificates to change the stated interest rate to 9%.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accrued liabilities could include all of the following except:

A) salaries payable.

B) current portion of long-term debt.

C) income tax payable.

D) interest payable.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A contingent liability is recorded by making an appropriate journal entry if the likelihood of a loss is remote.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The three key pieces of information that are stated on a bond certificate are:

A) the interest payment, the face value of the bond, and the credit rating of the company.

B) the market interest rate, the price of the bond, and the maturity date.

C) the stated interest rate, the face value of the bond, and the maturity date.

D) the interest payment, the issue price of the bond, and the credit rating of the company.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 133

Related Exams