A) The receivables turnover ratio indicates the average number of times the company completes the selling and collecting cycle during the year.

B) The days-to-collect measure is 365 days divided by the receivables turnover ratio.

C) The receivables turnover ratio and days-to-collect measure move in opposite directions.

D) A high receivables turnover ratio means a slower turnover.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All other things equal, a company is better off when it's receivable turnover ratio:

A) and its days-to-collect measure are both low.

B) is high and its days-to-collect measure is low.

C) and its days-to-collect measure are both high.

D) is low and its days-to-collect measure is high.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

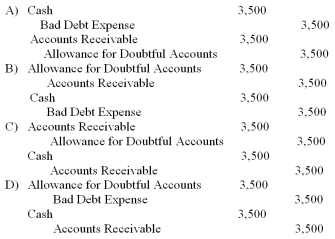

The required entry(ies) on May 29 to record the recovery is:

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

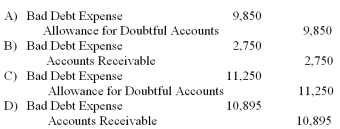

Assuming the company uses the aging of receivables method and estimates the uncollectible amount at 5% of accounts receivable, what is the required adjusting entry to record bad debt expense for the year?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Johnstone Supplies, Inc., writes off $3,081 of uncollectible accounts during August, 2011, the unadjusted account balance in the allowance for doubtful accounts on August 31, 2011 will be:

A) $30,931.

B) $5,065.

C) $34,012.

D) $1,984.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When interest is calculated for periods shorter than a year, the formula to calculate interest is:

A) I = P x R x T, where I = interest calculated, P = principal, R = annual interest rate, and T = number of months.

B) I = P x R x T, where I = interest calculated, P = principal, R = annual interest rate, and T = (number of months 12)

C) I = P x R x T, where I = interest calculated, P = principal, R = monthly interest rate, and T = (number of months 12) .

D) I = (MV - P) /T, where I = interest calculated, MV = maturity value, P = principal and T = number of months.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The percentage of credit sales method, also called the income statement approach, estimates bad debts based on a historical percentage of sales that lead to bad debt losses.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The aging of accounts receivable method is based upon the principle that the longer an account is overdue, the higher the risk of nonpayment.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Neither GAAP nor IFRS allow the use of the direct write-off method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company attempts to artificially inflate current sales and net income by shipping goods that have not been ordered, we would expect that the receivables turnover ratio will:

A) rise and the days-to-collect will rise, all other things equal.

B) rise and the days-to-collect will fall, all other things equal.

C) fall and the days-to-collect will fall, all other things equal.

D) fall and the days-to-collect will rise, all other things equal.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding methods of accounting for bad debts is true?

A) When the allowance method is used, the journal entry to write-off an uncollectible account does not change the amount reported as net accounts receivable on the balance sheet.

B) The two methods of accounting for bad debts that are acceptable under GAAP are the allowance method and the direct write-off method.

C) When the allowance method is used, if actual results differ from the estimates, the prior year financial statements must be corrected.

D) When the allowance method is used, bad debt expense is equal to the write-offs that occurred during the

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Purrfect Pets, Inc., had sales revenue of $1,748,380 during 2011. The company had credit card discounts of $16,280 and sales returns of $3,460. The balance in accounts receivable on December 31, 2010 was $104,500 and on December 31, 2011 it was $129,100. Calculate the receivables turnover ratio and days to collect measure for 2011 (round each calculate to one decimal place).

Correct Answer

verified

Correct Answer

verified

Multiple Choice

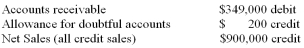

A company uses the percentage of credit sales method to estimate bad debt expense. At the end of the year, the company's unadjusted trial balance includes the following:  The company estimates, based on historical bad debt losses, that 0.5% of the sales will be uncollectible. What is the bad debt expense to be recorded for the year?

The company estimates, based on historical bad debt losses, that 0.5% of the sales will be uncollectible. What is the bad debt expense to be recorded for the year?

A) $4,500

B) $4,300

C) $4,700

D) $5,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On July 1, 2011, Icespresso Inc. signed a two-year $8,000 note receivable with 9 percent interest. At its due date, July 1, 2013, the principal and interest will be received in full. Interest revenue should be reported on Icepresso's income statement for the year ended December 31, 2011, in the amount of:

A) $1,440.

B) $720.

C) $420.

D) $360.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your company wrote off $350 in accounts receivable two months ago when a customer went bankrupt. That customer reorganizes and now pays the $350. Your company should:

A) debit Bad Debt Expense and credit Cash.

B) debit Accounts Receivable and credit Bad Debt Expense and then debit Allowance for Doubtful Accounts and credit Cash.

C) debit Cash and credit Bad Debt Expense.

D) debit Accounts Receivable and credit Allowance for Doubtful Accounts and then debit Cash and credit

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The unadjusted trial balance at the end of the year includes the following:  The company uses the allowance method and has completed the aging schedule which indicates $5,800 of accounts are estimated uncollectible. What is the amount of bad debt expense to be recorded for the year?

The company uses the allowance method and has completed the aging schedule which indicates $5,800 of accounts are estimated uncollectible. What is the amount of bad debt expense to be recorded for the year?

A) $5,800

B) $4,800

C) $6,800

D) $7,800

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the annual rate of interest being charged on a 9-month note receivable of $50,000 if the total interest is $3,000?

A) 6%

B) 8%

C) 12%

D) 10%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company lends its CEO $150,000 for 3 years at a 6% annual interest rate. Interest payments are to be made twice a year. Each interest payment will be for:

A) $9,000.

B) $750.

C) $4,500.

D) $1,500.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The allowance method for estimating bad debts that focuses on the balance sheet rather than the income statement is based on

A) a direct write-off.

B) an aging of the receivables.

C) credit sales.

D) net sales.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Other things being equal, a two-year note receivable should yield more interest revenue than a one-year note.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 140

Related Exams