A) 14.0 years

B) 9.7 years

C) 8.9 years

D) 10.3 years

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Questions 7 through 10 are based on the following information: Tongas Company applies revaluation accounting to plant assets with a carrying value of $1,600,000, a useful life of 4 years, and no salvage value. Depreciation is calculated on the straight-line basis. At the end of year 1, independent appraisers determine that the asset has a fair value of $1,500,000. -The entry to record depreciation for this same asset in year two will include a

A) debit to Accumulated Depreciation for $400,000.

B) debit to Depreciation Expense for $500,000.

C) credit to Accumulated Depreciation for $300,000.

D) debit to Depreciation Expense for $400,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 2008, Forrest Company purchased equipment at a cost of $130,000. The equipment was estimated to have a salvage value of $4,000 and it is being depreciated over eight years under the sum-of-the-years'-digits method. What should be the charge for depreciation of this equipment for the year ended December 31, 2015?

A) $3,500

B) $3,611

C) $16,250

D) $15,750

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

IFRS permits companies to carry assets at historical cost or use a revaluation model for fixed assets. According to IAS 16, if revaluation is used:1. it must be applied to all assets in a class of assets.2. assets must be revalued on an annual basis.3. assets must be depreciated on the straight-line basis.4. salvage values must be zero.

A) 1 is correct

B) 2 is correct

C) 1 and 2 are correct

D) All of these answers are correct

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If income tax effects are ignored, accelerated depreciation methods

A) provide funds for the earlier replacement of fixed assets.

B) increase funds provided by operations.

C) tend to offset the effect of steadily increasing repair and maintenance costs on the income statement.

D) tend to decrease the fixed asset turnover ratio.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The most common method of recording depletion for accounting purposes is the

A) percentage depletion method.

B) decreasing charge method.

C) straight-line method.

D) units-of-production method.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ramos Co. purchased machinery that was installed and ready for use on January 3, 2014, at a total cost of $115,000. Salvage value was estimated at $15,000. The machinery will be depreciated over five years using the double-declining balance method. For the year 2015, Ramos should record depreciation expense on this machinery of

A) $24,000.

B) $27,600.

C) $30,000.

D) $46,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Unlike U.S. GAAP, interest costs incurred during construction are not capitalized under IFRS.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carson Company purchased a depreciable asset for $280,000. The estimated salvage value is $14,000, and the estimated useful life is 10,000 hours. Carson used the asset for 1,500 hours in the current year. The activity method will be used for depreciation. What is the depreciation expense on this asset?

A) $26,600

B) $39,900

C) $44,100

D) $266,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Regis Inc. bought a machine on January 1, 2004 for $400,000. The machine had an expected life of 20 years and was expected to have a salvage value of $40,000. On July 1, 2014, the company reviewed the potential of the machine and determined that its undiscounted future net cash flows totaled $200,000 and its discounted future net cash flows totaled $140,000. If no active market exists for the machine and the company does not plan to dispose of it, what should Regis record as an impairment loss on July 1, 2014?

A) $ 0

B) $11,000

C) $20,000

D) $71,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The major difference between the service life of an asset and its physical life is that

A) service life refers to the time an asset will be used by a company and physical life refers to how long the asset will last.

B) physical life is the life of an asset without consideration of salvage value and service life requires the use of salvage value.

C) physical life is always longer than service life.

D) service life refers to the length of time an asset is of use to its original owner, while physical life refers to how long the asset will be used by all owners.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

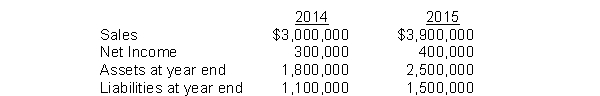

Sifton Company reported the following data:  What is Sifton's asset turnover for 2015?

What is Sifton's asset turnover for 2015?

A) 1.56

B) 1.61

C) 1.81

D) 2.17

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On July 1, 2014, Nowton Co. purchased machinery for $168,000. Salvage value was estimated to be $7,000. The machinery will be depreciated over ten years using the double-declining balance method. If depreciation is computed on the basis of the nearest full month, Nowton should record depreciation expense for 2015 on this machinery of

A) $28,980.

B) $30,240.

C) $30,590.

D) $26,880.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

As with U.S. GAAP, IFRS requires that both direct and indirect costs in self-constructed assets be capitalized.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

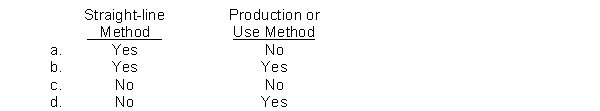

Net income is understated if, in the first year, estimated salvage value is excluded from the depreciation computation when using the

Correct Answer

verified

Correct Answer

verified

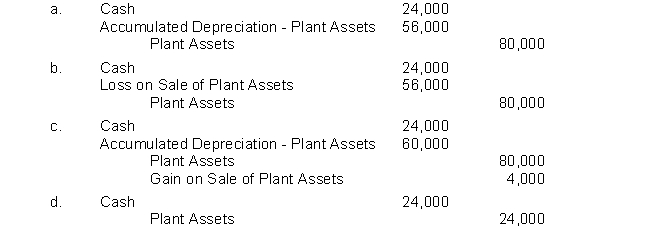

Short Answer

If Labor, Inc. uses the composite method and its composite rate is 7.5% per year, what entry should it make when plant assets that originally cost $80,000 and have been used for 10 years are sold for $24,000?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use of the double-declining balance method

A) results in a decreasing charge to depreciation expense.

B) means salvage value is not deducted in computing the depreciation base.

C) means the book value should not be reduced below salvage value.

D) all of these answers are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Falcon Company purchased a depreciable asset for $125,000. The estimated salvage value is $10,000, and the estimated useful life is 10 years. The straight-line method will be used for depreciation. What is the depreciation base of this asset?

A) $11,500

B) $12,500

C) $115,000

D) $125,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Composite or group depreciation is a depreciation system whereby

A) the years of useful life of the various assets in the group are added together and the total divided by the number of items.

B) the cost of individual units within an asset group is charged to expense in the year a unit is retired from service.

C) a straight-line rate is computed by dividing the total of the annual depreciation expense for all assets in the group by the total cost of the assets.

D) the original cost of all items in a given group or class of assets is retained in the asset account and the cost of replace?ments is charged to expense when they are acquired.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 3, 2013, Salazar Co. purchased machinery. The machinery has an estimated useful life of eight years and an estimated salvage value of $60,000. The depreciation applicable to this machinery was $130,000 for 2015, computed by the sum-of-the-years'-digits method. The acquisition cost of the machinery was

A) $720,000.

B) $780,000.

C) $840,000.

D) $936,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 156

Related Exams