A) 20

B) 100

C) 105

D) 120

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation may issue a stock dividend for which of the following reasons?

A) It may be short of cash and unable to pay a cash dividend.

B) It may want to increase the marketability of its stock by raising the price per share.

C) It may have a large debit balance in Retained Earnings and the directors may want to transfer part of this balance to the common stock account.

D) It may want to increase the stockholders' ownership in the corporation.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Income taxes for a corporation are normally reported as a separate expense item on the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Dividends on different classes of capital stock should be accounted for separately.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Santiago Corporation estimated at the beginning of 20-- that its income tax for the year would be $200,000. Calculate the estimated income tax per quarter and show one of the quarterly entries to pay the taxes.  As of December 31, 20-- Santiago Corporation had an actual tax liability of $200,437. Calculate the income tax due and make the necessary adjusting entry.

As of December 31, 20-- Santiago Corporation had an actual tax liability of $200,437. Calculate the income tax due and make the necessary adjusting entry.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the terms with the definitions. -A proportionate distribution of shares of a corporation's own stock to its stockholders.

A) cash dividend

B) date of declaration

C) date of payment

D) date of record

E) dividend

F) retained earnings appropriation

G) retained earnings statement

H) stock dividend

I) stock split

K) F) and G)

Correct Answer

verified

Correct Answer

verified

True/False

At year-end, an adjusting entry is necessary to recognize the correct amount of income taxes the corporation must pay for the year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Corporations are subject to specific corporate tax rates different from those for individuals.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The board of directors declared a $2 per share cash dividend on common stock and the corporation had 5,000 shares authorized and 4,000 shares outstanding and make a journal entry. The journal entry for the dividend payment would be

A) a debit to Cash Dividends for $8,000 and a credit to Common Dividends Payable for $8,000.

B) a debit to Cash Dividends for $10,000 and a credit to Common Dividends Payable for $10,000.

C) a debit to Cash Dividends Payable for $8,000 and a credit to Cash for $8,000.

D) a debit to Cash Dividends Payable for $10,000 and a credit to Cash for $10,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The board of directors declared a $2 per share cash dividend on common stock and the corporation had 5,000 shares authorized and 4,000 shares outstanding. The entry required to record the declaration of dividends would be

A) a debit to Cash and a credit to Common Dividends Payable.

B) a debit to Common Dividends Payable and a credit to Cash.

C) a debit to Retained Earnings and a credit to Common Dividends Payable.

D) a debit to Cash Dividends and a credit to Common Dividends Payable.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the terms with the definitions. -The date on which the names of stockholders entitled to receive the dividend are determined.

A) cash dividend

B) date of declaration

C) date of payment

D) date of record

E) dividend

F) retained earnings appropriation

G) retained earnings statement

H) stock dividend

I) stock split

K) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

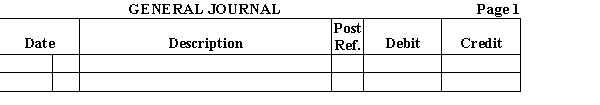

Pippin Company has 70,000 shares of $14 par common stock outstanding. On July 1, the board of directors declared a two-for-one stock split. Prepare the memorandum entry in the general journal indicating the new par value and the total number of outstanding shares of common stock.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the terms with the definitions. -The date on which the dividend is actually paid by the corporation.

A) cash dividend

B) date of declaration

C) date of payment

D) date of record

E) dividend

F) retained earnings appropriation

G) retained earnings statement

H) stock dividend

I) stock split

K) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Light Touch, Inc. has 110,000 shares of $8 par common stock outstanding. On July 1, the board of directors declared a two-for-one stock split. Prepare the memorandum entry in the general journal indicating the new par value and the total number of outstanding shares of common stock.

Correct Answer

verified

Correct Answer

verified

True/False

The ending balance of the retained earnings account on the statement of retained earnings is the same amount that appears in the stockholders' equity section of the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Appropriation of retained earnings has been used primarily to limit the availability of retained earnings for paying stockholders' dividends.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a corporation, the capital resulting from the retention of earnings is entered in the

A) cash account.

B) retained earnings account.

C) paid-in capital account.

D) income summary account.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A retained earnings appropriation is a restriction of retained earnings by

A) the board of directors.

B) stockholders.

C) senior management.

D) accountants.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Prepare the journal entry for the following transaction.

Apr. 15

Last year, Titan Corporation's board of directors appropriated $150,000 for the purchase of a new storage facility over a three-year period. This year's appropriation for $50,000 was made on this datE.

Correct Answer

verified

Correct Answer

verified

True/False

When an appropriation of retained earnings is made, total retained earnings is decreased.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 92

Related Exams