Correct Answer

verified

Correct Answer

verified

Short Answer

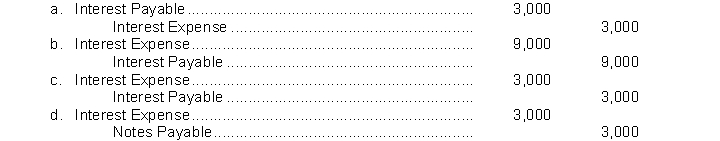

On September 1, Joe's Painting Service borrows $150,000 from National Bank on a 4-month, $150,000, 6% note. What entry must Joe's Painting Service make on December 31 before financial statements are prepared?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $1,000 face value bond with a quoted price of 98 is selling for

A) $1,000.

B) $980.

C) $908.

D) $98.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Current maturities of long-term debt refers to the amount of interest on a note payable that must be paid in the current year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Working capital is current assets divided by current liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Most notes are not interest bearing.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Each of the following accounts is reported as long-term liabilities except

A) Interest Payable.

B) Bonds Payable.

C) Discount on Bonds Payable.

D) Premium on Bonds Payable.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of sales tax collected by a retail store when making sales is

A) a miscellaneous revenue for the store.

B) a current liability.

C) not recorded because it is a tax paid by the customer.

D) recorded as an operating expense.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Premium on Bonds Payable is a contra account to Bonds Payable.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are reported as current liabilities except

A) accounts payable.

B) bonds payable.

C) notes payable.

D) unearned revenues.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When current liabilities are presented under IFRS, they are generally shown

A) alphabetically.

B) in order of magnitude.

C) in order of the dates they become due.

D) in order of liquidity.

IFRS.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

A current liability is a debt that can be expected to be paid within ______________ year or the ______________, whichever is longer.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

194. On January 1, Gage Corporation issues $1,000,000, 10-year, 12% bonds at 95 with interest payable on January 1. The carrying value of the bonds, using straight-line amortization, at the end of the third interest period is:

A) $965,000.

B) $970,000.

C) $930,000.

D) $935,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

223. On January 1, Dade Corporation issued $3,000,000, 7%, 5-year bonds with interest payable on December 31. The bonds sold for $3,216,288. The market rate of interest for these bonds was 6%. On the first interest date, using the effective-interest method, the debit entry to Interest Expense is for

A) $180,000.

B) $225,140.

C) $192,977.

D) $210,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If there is a loss on bonds redeemed early, it is

A) debited directly to Retained Earnings.

B) reported as an "Other Expense" on the income statement.

C) reported as an "Extraordinary Item" on the income statement.

D) debited to Interest Expense, as a cost of financing.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

When bonds are converted into common stock and the conversion is recorded, the ________________ of the bonds is transferred to paid-in capital accounts.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lark Corporation retires its $800,000 face value bonds at 104 on January 1, following the payment of annual interest. The carrying value of the bonds at the redemption date is $829,960. The entry to record the redemption will include a

A) credit of $2,040 to Loss on Bond Redemption.

B) debit of $2,040 to Loss on Bond Redemption.

C) credit of $32,040 to Premium on Bonds Payable.

D) debit of $32,000 to Premium on Bonds Payable.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

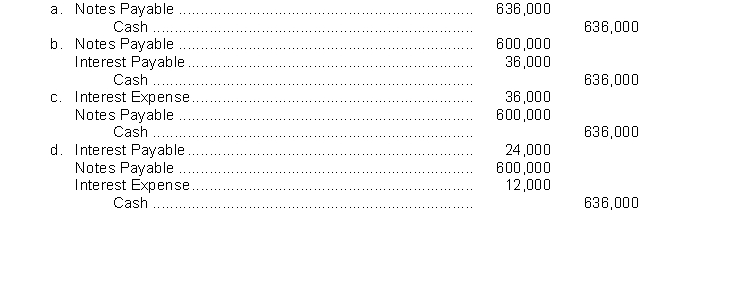

Admire County Bank agrees to lend Givens Brick Company $600,000 on January 1. Givens Brick Company signs a $600,000, 8%, 9-month note. What entry will Givens Brick Company make to pay off the note and interest at maturity assuming that interest has been accrued to September 30?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A legal document which summarizes the rights and privileges of bondholders as well as the obligations and commitments of the issuing company is called

A) a bond indenture.

B) a bond debenture.

C) trading on the equity.

D) a term bond.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

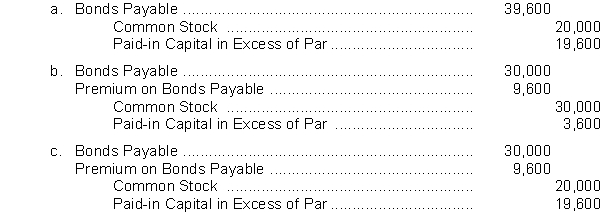

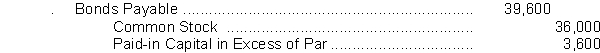

Short Answer

Thirty $1,000 bonds with a carrying value of $39,600 are converted into 4,000 shares of $5 par value common stock. The common stock had a market value of $9 per share on the date of conversion. The entry to record the conversion is  d

d

Correct Answer

verified

Correct Answer

verified

Showing 261 - 280 of 309

Related Exams