A) $450 cash outflow

B) $560 cash outflow

C) $870 cash outflow

D) $1,240 cash outflow

E) $1,570 cash outflow

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

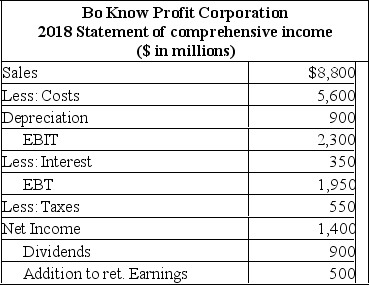

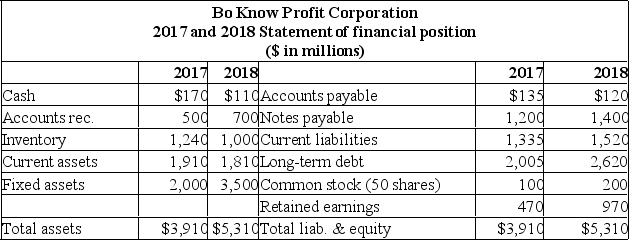

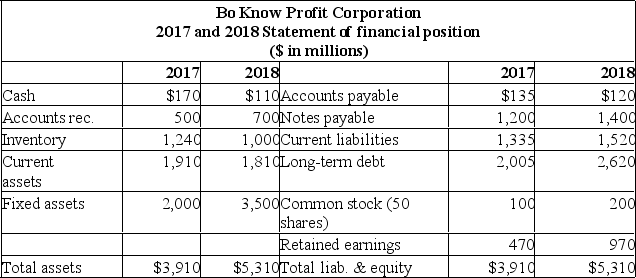

If you were to prepare a statement of cash flows, what is the cash flow from investment activities ($ in millions) ?

If you were to prepare a statement of cash flows, what is the cash flow from investment activities ($ in millions) ?

A) -$1,500

B) -$2,400

C) -$3,400

D) $4,500

E) $4,600

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A total asset turnover measure of 1.03 means that a firm has $1.03 in:

A) Total assets for every $1 in cash.

B) Total assets for every $1 in total debt.

C) Total assets for every $1 in equity.

D) Sales for every $1 in total assets.

E) Long-term assets for every $1 in short-term assets.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

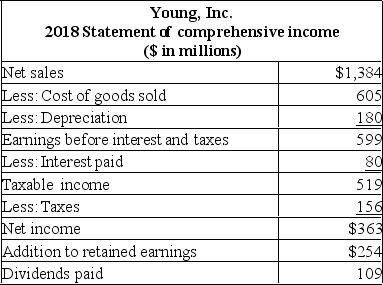

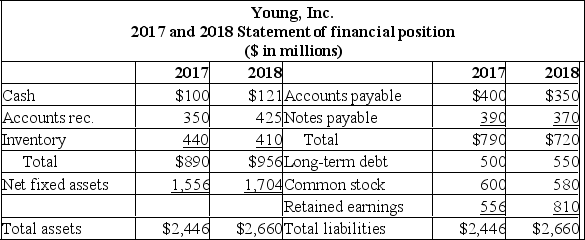

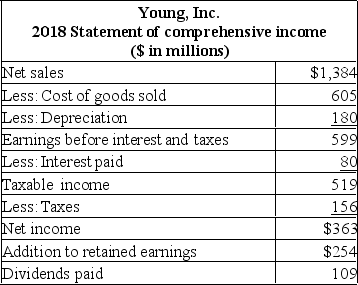

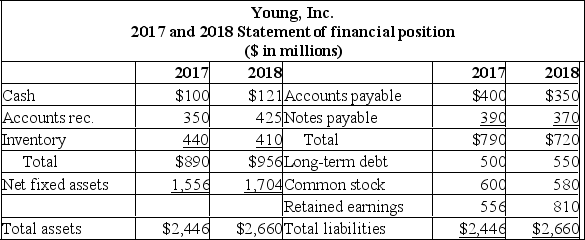

What was the return on equity for 2018?

What was the return on equity for 2018?

A) 18.3%

B) 26.1%

C) 31.4%

D) 44.8%

E) 62.6%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in a(n) _____________ account would be considered a(n) __________ of funds.

A) Asset; source

B) Liability; source

C) Liabilities; use

D) Expense; source

E) Revenues; use

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a common size statement, the statement of financial position may be expressed as a percentage of ____________ while the statement of comprehensive income may be expressed as a percentage of ____________.

A) liabilities plus equity; net income

B) assets; net income

C) sales; liabilities plus equity

D) liabilities plus equity; sales

E) liabilities; sales

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On a common-base year financial statement, all accounts are expressed relative to the base:

A) Year amount.

B) Amount of sales.

C) Amount of total assets.

D) Net income.

E) Net cash flow.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the year, Douglass Industries decreased the accounts receivable by $230, decreased the inventory by $150, and increased the accounts payable by $110. These three changes represent a _____ of cash.

A) $270 use

B) $490 use

C) $190 source

D) $270 source

E) $490 source

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A Halifax firm generates net income of $530. The depreciation expense is $60 and dividends paid are $80. Accounts payable decrease by $40, accounts receivable decrease by $30, inventory increases by $20, and net fixed assets decrease by $40. What is the net cash from operating activity?

A) $480

B) $530

C) $560

D) $580

E) $600

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm has a debt-equity ratio of.56. What is the total debt ratio?

A firm has a debt-equity ratio of.56. What is the total debt ratio?

A) 0.29

B) 0.36

C) 0.44

D) 1.44

E) 1.56

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

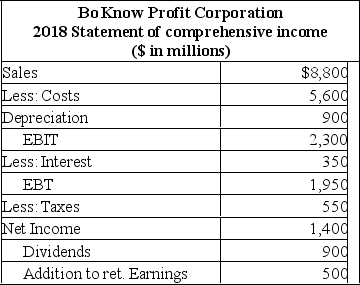

What was the greatest use of funds for Bo Knows Profit Corp.?

What was the greatest use of funds for Bo Knows Profit Corp.?

A) Increase in accounts receivable.

B) Decrease in accounts payable.

C) Acquisition of more fixed assets.

D) Dividends.

E) Sale of inventory.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Smith & Sons has a debt-equity ratio of.55. What is the total debt ratio?

A) .35

B) .46

C) .49

D) .51

E) .55

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The financial ratio measured as EBIT plus depreciation, divided by interest expense, is the:

A) Cash coverage ratio.

B) Debt-equity ratio.

C) Times interest earned ratio.

D) Gross margin.

E) Total debt ratio.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The function described as the profit margin times the total asset turnover times the equity multiplier is known as the:

A) Du Pont identity.

B) Return on assets.

C) Statement of cash flows.

D) Asset turnover ratio.

E) Interval measure.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An Edmonton firm has a debt-equity ratio of 62 %, a total asset turnover of 1.39, and a profit margin of 7.8 %. The total equity is $672,100. What is the amount of the net income?

A) $118,048

B) $119,600

C) $120,202

D) $121,212

E) $124,097

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sandwiches-To-Go has a return on equity of 12 % and a debt-equity ratio of.40. The total asset turnover is 1.63 and the profit margin is 5 %. The total equity is $21,400. What is the amount of the net income?

A) $2,568

B) $3,819

C) $4,186

D) $6,283

E) $6,420

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which ratio is not a measure of long-term solvency?

A) Total debt ratio.

B) Price-earnings ratio.

C) Debt/equity ratio.

D) Equity multiplier

E) Times interest earned.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm has a total debt ratio of .47. This means that that firm has 47 cents in debt for every:

A) $1.00 in equity.

B) $1.00 in total sales.

C) $1.00 in current assets.

D) $0.53 in equity.

E) $0.53 in total assets.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the base year, Marley Enterprises of Vancouver had cash of $560, accounts receivable of $2,650, inventory of $4,680, and fixed assets of $12,600. This year the firm has cash of $630, accounts receivable of $3,280, inventory of $5,101, and fixed assets of $15,850. What is the common-base year value of the inventory?

A) .25

B) .57

C) .65

D) 1.09

E) 1.30

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The PE ratio is defined as:

A) Dividends per share divided by earnings per share.

B) Earnings per share divided by dividends per share.

C) Price per share divided by earnings per share.

D) Earnings per share divided by price per share.

E) Price per share divided by equity per share.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 408

Related Exams