A) Japan

B) Greece

C) Italy

D) Canada

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

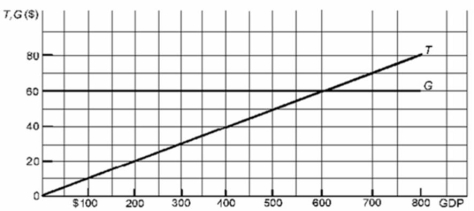

Refer to the above diagram where T is tax revenues and G is government expenditures.All figures are in billions of dollars.If the full-employment GDP is $400 billion while the actual GDP is $200 billion, the actual budget deficit is:

Refer to the above diagram where T is tax revenues and G is government expenditures.All figures are in billions of dollars.If the full-employment GDP is $400 billion while the actual GDP is $200 billion, the actual budget deficit is:

A) $200 billion.

B) $20 billion.

C) $40 billion.

D) $60 billion.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An expansionary fiscal policy in Canada might unintentionally cause demand-pull inflation if:

A) the dollar unexpectedly appreciates while the expansionary policy is in place.

B) the dollar unexpectedly depreciates while the expansionary policy is in place.

C) the policy produces severe crowding out.

D) our trading partners experience recession during the time of the fiscal policy action.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the above diagram where T is tax revenues and G is government expenditures.All figures are in billions of dollars.If the full-employment GDP and actual GDP are each $400 billion, this economy will realize a:

Refer to the above diagram where T is tax revenues and G is government expenditures.All figures are in billions of dollars.If the full-employment GDP and actual GDP are each $400 billion, this economy will realize a:

A) full-employment or structural deficit of $20 billion.

B) cyclical deficit of $20 billion.

C) cyclical surplus of $20 billion.

D) full-employment deficit of zero.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the above diagram wherein T is tax revenues and G is government expenditures.All figures are in billions.The equilibrium level of GDP in this economy:

Refer to the above diagram wherein T is tax revenues and G is government expenditures.All figures are in billions.The equilibrium level of GDP in this economy:

A) is $400.

B) is greater than $400.

C) is less than $400.

D) cannot be determined from the information given.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The "political business cycle" refers to the possibility that:

A) incumbent politicians will be re-elected regardless of the state of the economy.

B) politicians will manipulate the economy to enhance their chances of being re-elected.

C) there is more inflation during Liberal administrations than during Progressive Conservative administrations.

D) recessions coincide with election years.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(1) The composite index of leading indicators turns downward for three consecutive months; (2) Economists reach agreement that the economy is moving into a recession; (3) A tax cut is proposed in Parliament; (4) The tax cut is passed by Parliament; (5) Consumption spending begins to rise, aggregate demand increases, and the economy begins to recover.Refer to the above information.The recognition lag of fiscal policy is reflected in events:

A) 1 and 2.

B) 2 and 3.

C) 3 and 4.

D) 4 and 5.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Contractionary fiscal policy will do what to the government budget, assuming that was balanced at the start?

A) A budget deficit

B) A budget surplus

C) An increase in interest rates

D) A decrease in personal taxes

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If government tax revenues change automatically and in a countercyclical direction over the course of the business cycle, this would be called a(n) :

A) discretionary fiscal policy.

B) expansionary fiscal policy.

C) political business cycle.

D) nondiscretionary fiscal policy.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fiscal policy refers to the:

A) manipulation of government spending and taxes to stabilize domestic output, employment, and the price level.

B) manipulation of government spending and taxes to achieve greater equality in the distribution of income.

C) altering of the interest rate to change aggregate demand.

D) fact that equal increases in government spending and taxation will be contractionary.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Built-in stabilizers:

A) intensify the business cycle.

B) reduce the size of the multiplier.

C) increase the government's deficit during a recession.

D) are a part of discretionary fiscal policy.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the above graph.If the economy was initially in equilibrium at point 3 and interest rates increase by 4 percentage points, then the crowding-out effect would be:

Refer to the above graph.If the economy was initially in equilibrium at point 3 and interest rates increase by 4 percentage points, then the crowding-out effect would be:

A) $10 billion in investment.

B) $20 billion in investment.

C) $30 billion in investment.

D) $35 billion in investment.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A decrease in government spending and taxes would be an example of fiscal policies that reinforce each other.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

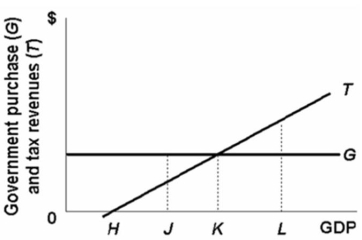

With the expenditures programs and the tax system shown in the above diagram:

With the expenditures programs and the tax system shown in the above diagram:

A) the public budget will be expansionary at all GDP levels above K, and contractionary at all GDP levels below K.

B) the public budget will be a destabilizing force at all levels of GDP.

C) deficits will be realized at income levels below K, and surpluses above K.

D) deficits will be realized at income levels below H, and surpluses above H.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 221 - 234 of 234

Related Exams